Marketplace growth in 2026 won’t be won by tactics alone.

The brands that scale profitably across Amazon, Walmart, and TikTok Shop are doing something fundamentally different: they’re planning for systems, not channels.

Over the past year, marketplace dynamics shifted in ways that exposed fragile strategies. CPC inflation accelerated unevenly. Conversion behavior diverged by platform. Discovery increasingly happened before shoppers ever searched.

The result? Many brands hit a growth ceiling they didn’t anticipate.

To avoid that outcome in 2026, sellers need a new planning framework—one built for cross-marketplace execution, full-funnel advertising, and AI-driven optimization.

This article breaks down the four marketplace planning pillars every brand needs to master in 2026, drawn from The 2026 Marketplace Planning Pillars: A Cross-Marketplace Guide to Scaling Amazon, Walmart, and TikTok Shop.

👉 Download the full guide here

Pillar 1: Marketplace Diversification Is a Growth Strategy, Not a Safety Net

For years, diversification was treated as insurance. Sell on multiple marketplaces so no single platform could derail your business.

That framing is outdated.

Amazon and Walmart now reward fundamentally different buyer behaviors:

- Amazon excels at higher AOV purchases and brand-led demand

- Walmart increasingly drives velocity, repeat purchasing, and price-sensitive conversion

- TikTok Shop introduces discovery-led commerce that influences downstream marketplace sales

Brands operating on only one marketplace don’t just take on risk—they limit the types of growth they can access.

Cross-marketplace brands gain:

- Stability when CPCs spike on one platform

- Incremental volume when demand shifts between channels

- More efficient inventory utilization across different purchase patterns

This is why cross-marketplace planning is no longer optional.

Pillar 2: Search Advertising Has a Ceiling — Full-Funnel Is How You Break It

Search advertising still matters. But it no longer scales infinitely.

Across Amazon and Walmart, competition has driven up CPCs—often without a corresponding lift in conversion. At the same time, shopper behavior has shifted:

- Discovery increasingly happens through video and social

- Upper-funnel media influences marketplace purchases

- Search is often the last touchpoint, not the first

Brands relying solely on bottom-funnel search are competing for demand that already exists.

Brands investing in full-funnel strategy are creating demand before auctions begin.

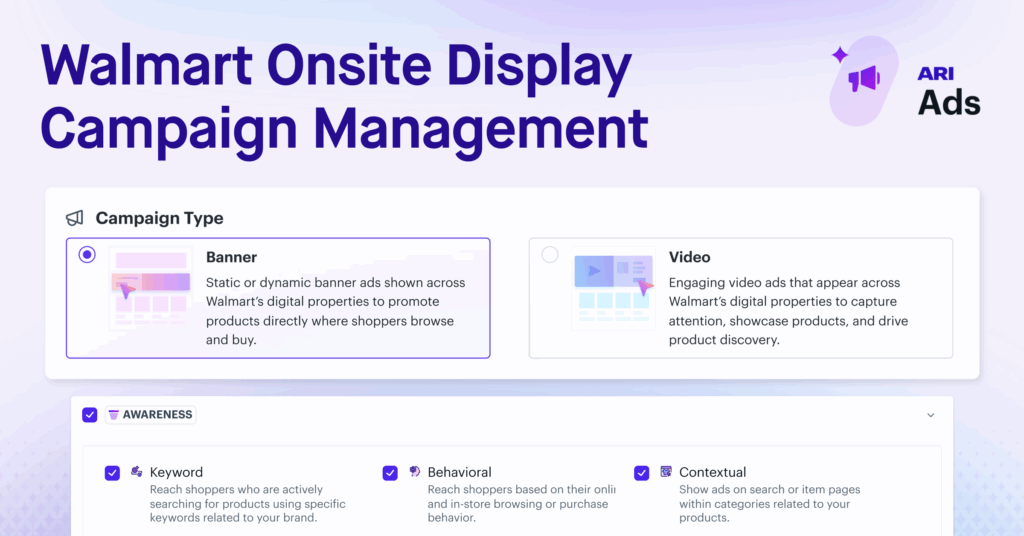

In 2026, effective full-funnel execution means:

- Using upper-funnel media to introduce and educate

- Reinforcing consideration with mid-funnel audiences

- Reserving search budgets for queries that drive incremental value

Search captures demand.

Full-funnel strategy creates it.

If you’re planning budget allocation for the year ahead, this guide may help: The Full-Funnel Amazon Advertising Playbook for Modern Sellers

Pillar 3: Generic AI Won’t Win Marketplaces — Retail-Trained AI Will

By 2026, “using AI” will be table stakes.

The real differentiator is what your AI understands.

Generic AI tools can generate copy and ideas. They cannot:

- React to real-time auction dynamics

- Adjust bids based on inventory constraints

- Optimize listings and advertising together

- Account for platform-specific relevance systems

Retail-trained AI is built for exactly those challenges.

It enables brands to:

- Optimize bids dynamically based on performance signals

- Align advertising decisions with inventory health

- Adapt creative and listings to each marketplace

- Scale optimization without linear increases in headcount

In 2026, AI isn’t an add-on tool.

It’s the operating layer for marketplace growth.

Pillar 4: Planning Must Be Cross-Marketplace From Day One

One of the most common planning failures brands make is working in silos.

Amazon forecasts live in one spreadsheet.

Walmart budgets are treated as experimental.

TikTok Shop is bolted on later.

That approach doesn’t survive modern marketplace complexity.

Cross-marketplace planning aligns:

- Inventory allocation with demand across platforms

- Budget pacing with full-funnel strategy

- Performance expectations with platform-specific realities

Brands that plan holistically avoid:

- Overspending on one channel while starving another

- Running out of inventory mid-campaign

- Measuring success inconsistently across marketplaces

Execution speed matters—but planning clarity matters more.

The Bottom Line: 2026 Will Reward Structure, Not Hustle

The brands that win in 2026 won’t be the ones grinding harder inside a single platform.

They’ll be the ones:

- Planning across Amazon, Walmart, and TikTok Shop

- Building full-funnel strategies that scale beyond search

- Using retail-trained AI to optimize faster than manual teams

- Treating marketplaces as a connected growth system

If your 2026 planning still looks like last year’s approach, it’s already outdated.

Download the Full Guide: The 2026 Marketplace Planning Pillars

This article only scratches the surface.

The full ebook covers:

- How to plan growth across Amazon, Walmart, and TikTok Shop

- Where brands are misallocating spend today

- How AI reshapes marketplace execution

- What top-performing teams are doing differently heading into 2026