Selecting the best Amazon ad optimization partner for e-commerce brands isn’t about a single “winner”—it’s about fit, transparency, and measurable ROI. The right choice aligns technology, expertise, and governance to your goals, proving value in a low-risk pilot before scaling. This guide offers executives a step-by-step, data-first framework to evaluate partners on criteria that matter most: integration depth, analytics rigor, creative and media sophistication, operational discipline, and compliant scalability. If you need a transparent, AI-powered copilot that pairs automation with expert strategy, Teikametrics is designed for this mandate.

Explore Amazon Advertising Optimization with Teikametrics

Teikametrics helps brands optimize Amazon advertising using AI-powered bidding, Amazon Marketing Cloud (AMC) insights, and expert oversight—so you can improve ACOS and ROAS without sacrificing transparency or control.

→ Request a demo of Teikametrics for Amazon Advertising

Define Your Advertising Objectives and Key Performance Indicators

The fastest way to waste budget is to start without clear objectives and KPIs. Aligning on outcomes upfront—then asking partners to map their approach to those outcomes—keeps everyone focused and accountable. Define whether you’re prioritizing lowering ACOS, increasing ROAS, decreasing CAC, growing market share, or expanding new product launches. Socialize those goals early with potential partners and request a proposed measurement plan and reporting cadence. As Amazon’s Marketing Optimization guide emphasizes, alignment and clarity reduce risk and enable disciplined iteration throughout testing and scale-up phases (see Amazon’s Marketing Optimization guide).

Foundational Amazon advertising KPIs—and how to explain them internally:

“LTV, or lifetime value, is the total contribution margin expected from a customer over time.”

“ACOS, or Advertising Cost of Sale, is the percentage of ad spend relative to revenue generated by ads.”

“ROAS, or Return on Ad Spend, is revenue generated per dollar of ad spend.”

“CTR, or click-through rate, is the share of impressions that result in clicks.”

“Conversion rate is the share of ad clicks that result in a purchase.”

“CAC, or customer acquisition cost, is the cost to acquire a new customer.”

Objective-to-KPI alignment you can use in briefings and reviews:

KPI: ACOS

Quick definition: Ad spend / ad-attributed revenue

Primarily supports: Profit efficiency, margin targets

Also informs: Budget pacing, bid aggressiveness

KPI: ROAS

Quick definition: Revenue / ad spend

Primarily supports: Revenue growth, scale efficiency

Also informs: Channel mix, seasonal pushes

KPI: CTR

Quick definition: Clicks / impressions

Primarily supports: Creative relevance, keyword fit

Also informs: Listing quality cues

KPI: Conversion Rate

Quick definition: Orders / clicks

Primarily supports: Detail page readiness, audience quality

Also informs: Funnel gaps, pricing tests

KPI: CAC

Quick definition: Spend per new customer

Primarily supports: New-to-brand growth

Also informs: Media mix, remarketing caps

KPI: LTV

Quick definition: Margin over time

Primarily supports: Willingness to pay CAC

Also informs: Subscription, cross-sell strategy

Set your risk tolerance early—how much variance in ACOS/ROAS can you accept during testing? That boundary should govern partner proposals, change windows, and pilot guardrails, a best practice stressed in Amazon’s Marketing Optimization guide.

Assess Technology and Integration Capabilities

Great strategy fails without reliable, real-time data and automation. Confirm that each partner has API-level integration—the technical ability for platforms to communicate and exchange data in real time without manual intervention—across your stack. Specifically, require verified connections to Seller Central, Amazon Ads Console and API, Amazon Marketing Cloud (AMC), Amazon Attribution, Amazon DSP, and any third-party tools in your analytics, merchandising, or finance workflows. API access enables automated bidding, inventory-aware pacing, and unified cross-channel views—all prerequisites for rapid optimization and scale, as highlighted in reviews of advanced analytics APIs for Amazon Ads.

Cross-platform connectors also matter. Partners that unify retail, media, and finance signals can deliver multi-channel ROAS analysis and executive dashboards that track performance alongside stock levels and buy box status (see this overview of an Amazon Ads dashboard approach).

Use this integration checklist during evaluations:

Integration area: Seller Central (retail feeds)

Verify in discovery: Real-time catalog, pricing, inventory, buy box

Why it matters: Inventory-aware pacing, wasted-spend prevention

Integration area: Amazon Ads API / Console

Verify in discovery: Sponsored Products, Sponsored Brands, Sponsored Display control

Why it matters: Automated bidding, budget rules, bulk operations

Integration area: Amazon Marketing Cloud (AMC)

Verify in discovery: Clean room access and query capability

Why it matters: Path-to-conversion analysis, incrementality, frequency controls

Integration area: Amazon Attribution

Verify in discovery: Off-Amazon media tracking to Amazon sales

Why it matters: Cross-channel measurement, upper-funnel valuation

Integration area: Amazon DSP

Verify in discovery: Audience building and programmatic activation

Why it matters: Prospecting and retargeting at scale

Integration area: Pricing and promotions data

Verify in discovery: Coupons, deals, list-price changes

Why it matters: Align bids with price competitiveness

Integration area: Third-party analytics / BI

Verify in discovery: ETL to data warehouse or BI tools

Why it matters: Single source of truth for finance and operations

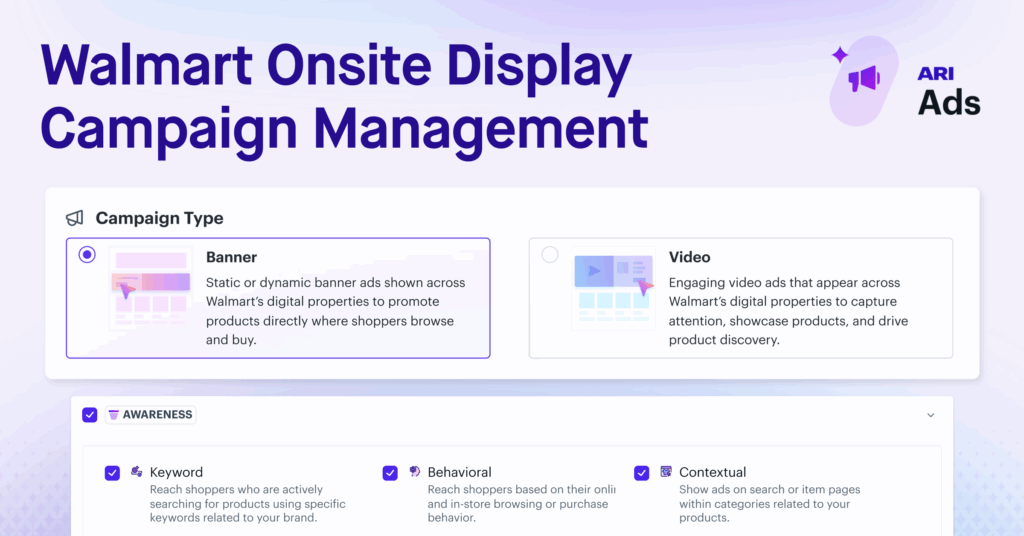

Integration area: Multi-marketplaces

Verify in discovery: Walmart, Target, eBay, DTC pixel data

Why it matters: Portfolio steering and budget rebalancing

What enterprise-grade Amazon Ads integration looks like in practice

Teikametrics integrates directly with Amazon Ads, AMC, Attribution, DSP, and Seller Central to enable inventory-aware pacing, automated bid and budget controls, and unified retail + media reporting—all in one platform.

→ See how Teikametrics integrates with Amazon Advertising

Evaluate Measurement and Analytics Tools

Optimization is only as good as your measurement. Look for multi-touch attribution—the ability to track how several ad and media interactions jointly drive conversions instead of crediting just a single click or impression. Prioritize platforms that combine Amazon Attribution for off-Amazon measurement and AMC for privacy-safe, cross-channel analysis; both enable better budgeting between discovery and conversion stages, as highlighted in advanced analytics resources for Amazon Ads.

Your analytics toolkit should offer both drill-downs and roll-ups: ASIN-level insights for tactical tuning, plus consolidated executive views that surface ACOS, ROAS, CPC, and inventory/buy box status across regions and marketplaces, an approach showcased in Amazon Ads dashboard implementations.

Compare analytics capabilities with this rubric:

Capability: Multi-touch attribution

What good looks like: AMC queries with cohort and path reports

Why it matters: Values assisting media and identifies waste

Capability: ASIN-level drilldowns

What good looks like: Keyword, placement, and query performance

Why it matters: Pinpoints levers for bids, negatives, and content

Capability: Executive rollups

What good looks like: Weekly/MoM rollups by brand/region

Why it matters: Board-ready transparency and accountability

Capability: Cohort/LTV analysis

What good looks like: New-to-brand, repeat rate, LTV:CAC

Why it matters: Informs how far to push prospecting

Capability: Scheduled/push reporting

What good looks like: Slack/email alerts, anomaly flags

Why it matters: Faster reaction to spikes and stockouts

Capability: Inventory overlays

What good looks like: Buy box, stock, price changes

Why it matters: Prevents spend when you can’t convert

Turning AMC insights into day-to-day optimization

Access to AMC data is only valuable if it informs action. Teikametrics operationalizes AMC and Amazon Attribution—using clean-room insights to drive bidding decisions, audience strategy, and executive-ready reporting.

→ See how Teikametrics uses AMC to optimize Amazon Ads

Review Creative and Media Optimization Services

Creative and media choices determine whether you win the impression and the cart. Seek partners with dynamic creative optimization—the use of AI to personalize ad images, copy, or placements based on user behavior and context—as described in Amazon Ads optimization best practices. Beyond creative, confirm they run disciplined A/B tests, bring programmatic DSP expertise, and practice careful bid management to minimize overspend, a point reinforced in Amazon DSP best practices.

Evidence matters. Amazon reports that ghd audiences exposed to both DSP and Sponsored Products delivered 50% higher conversions vs. single-channel exposure, demonstrating the power of an orchestrated media mix (see Amazon’s Marketing Optimization guide).

Capabilities to compare:

- Creative optimization: templated and bespoke assets, auto-refresh of variations, placement-aware messaging.

- A/B and multivariate testing: pre-registered hypotheses, minimum sample sizes, and runtime caps to limit risk.

- Media mix tactics: balanced prospecting/retargeting, frequency controls, Sponsored vs. DSP budget rules, dayparting, and query-level negatives.

Understand the Operational Model and Governance

How the work gets done is as important as the tech. Before you sign, clarify campaign ownership, change authority, and the balance of automation vs. manual controls. Lock in reporting cadence, stakeholder roles, and escalation paths. To de-risk, require a 4–8 week pilot with agreed KPIs and a rollback clause—an approach consistent with Amazon’s Marketing Optimization guide. Also, request recent, quantifiable case studies; for example, Amazon cites Bounce achieving 12% total sales growth while ACOS improved from 40.4% to 27.6% year over year, illustrating the kind of measurable impact you should expect.

Operational evaluation questions to ask:

- Who owns bidding and budget changes day-to-day? What’s the approval workflow?

- How often do we receive executive summaries, and what’s included?

- Will we have live dashboard access at the ASIN and search term level?

- What are the SLAs for launches, creative swaps, and critical escalations?

- How are learnings documented and rolled into playbooks?

Consider Scale, Pricing, and Compliance Factors

Your partner should scale across SKUs, regions, and marketplaces without adding complexity. Confirm they can support Amazon, Walmart, and DTC in one view with consistent KPI definitions and governance. Clarify pricing models—flat fee, percent of ad spend, or pay-for-performance—and model each against your margin structure and seasonality.

Compliance is non-negotiable. A consent string is a standardized record of user privacy consent for data processing; it’s required for certain third-party data uploads to DSP as of February 2025, with accepted formats including IAB TCF and the Amazon Consent Signal (see Amazon DSP best practices). Validate how the partner ingests, stores, and proves consent, and how they handle data subject requests.

Scale and compliance vetting checklist:

- Multi-marketplace roadmap and resourcing plan

- Clear pricing tied to outcomes, not hidden ad tech fees

- Documented consent and DSP compliance processes

- Regional data residency and security certifications

- Business continuity and change management plans

Conduct a Pilot Program with Clear Success Criteria

Run a 4–8 week pilot that tests both technology and service. Align KPIs and transparency standards upfront: ASIN-level reporting, weekly executive summaries, and live dashboard access. Explicitly test both automated and manual workflows to assess platform intelligence and human-in-the-loop controls. Set review points at mid-pilot and end-of-pilot to validate data access, quality, and outcomes, and include an exit and knowledge-transfer plan, as recommended in Amazon’s Marketing Optimization guide.

Use a simple pass/fail scorecard:

Pilot KPI: ACOS improvement

Measurement method: Compare to prior 4–8 week baseline

Pass/Fail criteria: ≥10–20% improvement at stable revenue

Pilot KPI: ROAS uplift

Measurement method: Revenue / ad spend, normalized for seasonality

Pass/Fail criteria: ≥15% uplift or explained variance

Pilot KPI: Data freshness

Measurement method: API latency logs and dashboard timestamps

Pass/Fail criteria: ≥95% of data under 4-hour latency

Pilot KPI: Attribution coverage

Measurement method: Share of orders mapped via Attribution / AMC

Pass/Fail criteria: ≥80% of off-Amazon campaigns mapped

Pilot KPI: Issue response time

Measurement method: Ticketing timestamps

Pass/Fail criteria: 90% within SLA (e.g., 1 business day)

Run a low-risk Amazon Ads optimization pilot

Teikametrics offers structured 4–8 week pilots designed to prove value quickly—using clear KPIs, live dashboards, and both automated and human-in-the-loop controls before you scale.

Finalize Contract Terms and Establish Exit Plans

Codify transparency and protection before launch. Your contract should outline SLAs, communication cadence, and knowledge-transfer mechanics. Specify metric definitions, dashboard access, data export rights, and auditability of change logs. Include an exit plan that details data access, transition timelines, and notice periods so you can move or scale with confidence.

Contract and exit plan must-haves:

Area: SLAs

Must-have term: Response, launch, and change-window SLAs

Why it matters: Reliability and accountability

Area: Reporting

Must-have term: Weekly executive summaries; live dashboards

Why it matters: Ongoing transparency

Area: Data rights

Must-have term: API credentials, raw exports, codebooks

Why it matters: Portability and auditability

Area: Governance

Must-have term: Change logs and approval workflows

Why it matters: Risk control and traceability

Area: Pricing

Must-have term: Clear fees; no hidden media or tech markups

Why it matters: Margin protection

Area: Exit

Must-have term: 30–60 day notice; knowledge transfer and runbooks

Why it matters: Business continuity

Frequently asked questions

What key metrics should I track to evaluate Amazon advertising performance?

Track ACOS, ROAS, CTR, conversion rate, and ASIN-level sales to quantify efficiency and growth, then layer in CAC and LTV to guide how aggressively you can scale.

How important is API-level integration with Amazon Advertising platforms?

It’s critical—real-time APIs enable automated bidding, inventory-aware pacing, unified tracking, and faster optimizations that improve both efficiency and scalability.

What role does automation play in optimizing Amazon ad campaigns?

Automation accelerates bid and budget adjustments, surfaces anomalies, and streamlines reporting, while expert oversight ensures tests, targets, and guardrails remain aligned to profit.

How can I ensure transparency and control when working with an optimization partner?

Require live dashboards, ASIN and search term reporting, documented change logs, and a fixed reporting cadence with executive summaries.

What are best practices for running a pilot to select the right partner?

Set clear KPIs and guardrails, test automated and manual workflows, mandate weekly reviews, and include a pre-agreed exit and knowledge-transfer plan.

Ready to modernize your Amazon Advertising optimization?

Teikametrics helps brands improve advertising performance on Amazon through AI-driven bidding, AMC-powered measurement, and disciplined operational governance—so growth is profitable, measurable, and scalable.

→ Schedule a demo of Teikametrics for Amazon Advertising Optimization