Walmart’s online marketplace has reached a major milestone, surpassing 200,000 active sellers for the first time – driven by the fastest rate of seller growth in the platform’s history. In just the first five months of 2025, Walmart added 44,000 new sellers (versus 59,000 in all of 2024) , putting it on pace for its highest growth year yet. This explosive expansion not only solidifies Walmart.com as a rising e-commerce force, but also sends a clear message to brands and merchants: relying on a single marketplace is no longer enough. It’s time to embrace a multi-marketplace strategy.

Walmart Marketplace’s Explosive Growth in 2025

Walmart Marketplace has been growing at breakneck speed in 2024 and 2025. To appreciate the scale of this expansion, consider some key stats from recent Marketplace Pulse research:

- Seller Count Milestone: Walmart’s marketplace crossed 200,000 active sellers for the first time in mid-2025 . This is a huge leap for a platform that only opened to third-party sellers a few years ago.

- Rapid Seller Addition: 44,000 new sellers joined in the first five months of 2025 alone, compared to 59,000 in all of 2024 . That’s a 30% increase in seller count in under half a year . At this pace, Walmart could add over 100,000 sellers in 2025 – nearly doubling the growth seen in 2024, when the marketplace grew 60% to reach ~160,000 sellers.

- Massive Product Catalog: There are now over 420 million products available on Walmart.com – 95% of which are from marketplace third-party sellers . Walmart’s latest “Who Knew?” ad campaign highlights this expanded assortment (over half a billion items online) to reposition Walmart.com as a vast, modern e-commerce destination . In other words, the vast majority of Walmart’s online selection now comes from marketplace sellers, not Walmart’s own inventory.

- Global Seller Base: Walmart only opened its marketplace to international sellers in 2021, yet foreign sellers now make up a significant portion of the platform. Nearly 60% of new sellers in 2025 are from China, and Chinese merchants now represent 34% of all active Walmart sellers . This mirrors the international seller dominance seen on other marketplaces and marks a swift shift in Walmart’s seller demographics. (For comparison, it took Amazon nearly a decade for its marketplace to reach a similar level of Chinese seller penetration, whereas Walmart achieved one-third international sellers in just four years.

These figures underscore how rapidly Walmart’s marketplace has evolved. Such growth brings clear benefits to Walmart – notably a broader product selection that strengthens its position against Amazon – but also introduces challenges in maintaining quality and consistency at scale . For third-party sellers, however, the message is clear: Walmart.com has emerged as the next major e-commerce frontier, and the opportunity on this platform is accelerating.

What Walmart’s Growth Means for Online Sellers

Walmart’s marketplace expansion has effectively transformed the retailer into a formidable online channel that no serious seller can ignore. A few years ago, many brands focused primarily on Amazon; today, Walmart is rapidly becoming the second pillar of e-commerce in the U.S. (after Amazon). In fact, Walmart’s marketplace is now the second-largest U.S. e-commerce marketplace by traffic, boasting around 120 million unique monthly visitors (as of 2021) compared to Amazon’s 200 million . This means millions of potential customers are shopping on Walmart.com – a massive audience that sellers might be missing if they only sell on Amazon or their own website.

Walmart’s momentum is a wake-up call for multi-channel selling. The platform’s growth – from its aggressive seller recruitment to the sheer increase in products – signifies that customer demand is booming on Walmart.com. The company is leveraging its 4,600 physical stores for online fulfillment and offering services like 2-day shipping through Walmart+ to attract shoppers . Moreover, Walmart’s recent marketing emphasizes its endless online aisle, implicitly telling shoppers “you can find everything here.” For sellers, this creates an enormous opportunity to expand sales beyond Amazon’s ecosystem and tap into Walmart’s growing customer base.

It’s worth noting that international sellers (particularly from China) have been quick to seize this opportunity on Walmart . They now account for a third of Walmart’s marketplace, selling everything from electronics to home goods. This influx has made Walmart.com start to resemble Amazon’s marketplace dynamics in terms of competition and product breadth . For U.S.-based and other domestic sellers, the implication is clear: if you don’t establish a presence on Walmart soon, your competitors (often overseas sellers) will gladly fill the gap and capture that market share. In short, Walmart’s record growth has made it too big to ignore.

Why a Multi‑Marketplace Strategy Is More Important Than Ever

The days of putting all your eggs in one basket (or one marketplace) are over. Sellers who adopt a multi-marketplace strategy – selling on Amazon, Walmart, and other channels – stand to gain significant advantages in today’s e-commerce landscape:

- Reach New Customers: Each marketplace has its own dedicated shopper base. By expanding beyond Amazon to platforms like Walmart, you expose your products to entirely new audiences. Remember, Walmart.com sees hundreds of millions of visits and many of these shoppers may not be Amazon regulars . Multi-channel sellers can capture consumers looking for alternatives and increase their overall sales potential with almost nothing to lose .

- Diversify Your Revenue (and Risk): Relying on a single marketplace means your business is vulnerable to that platform’s policy changes, algorithm shifts, or account health issues. Diversifying your sales channels creates multiple income streams, providing a buffer if one channel experiences a downturn. In fact, multi-marketplace selling is one of the easiest ways to grow your business without major internal changes . It improves your financial agility by ensuring you always have another revenue stream if, say, your Amazon account gets suspended or sales slow down . Even if one account faces challenges, another marketplace can keep revenue flowing and mitigate risk.

- Reduced Competition & Early Mover Advantage: While Amazon is more mature (with millions of sellers), Walmart’s marketplace is still in a high-growth phase. This presents an opportunity to get in early and establish a strong presence on Walmart before it becomes as crowded as Amazon. Many savvy Amazon sellers have already started expanding to Walmart to get ahead of the competition . By being on both platforms, you ensure you’re not missing out on Walmart’s growth and you can capture share in an arena where not all your Amazon competitors are present yet.

- Higher Resilience and Flexibility: A multi-channel approach makes your business more resilient. Seasonal trends, category performance, or even advertising costs can differ between marketplaces. For example, if advertising becomes too expensive on Amazon, you might find better ROI on Walmart ads, and vice versa. You can adjust strategies per channel. Overall, having multiple streams allows you to adapt more fluidly to market changes.

What Should Sellers Do Next?

Here’s how sellers can take advantage of Walmart’s breakout growth:

✅ Establish early presence – More competition is coming. Start building reviews, brand trust, and momentum now.

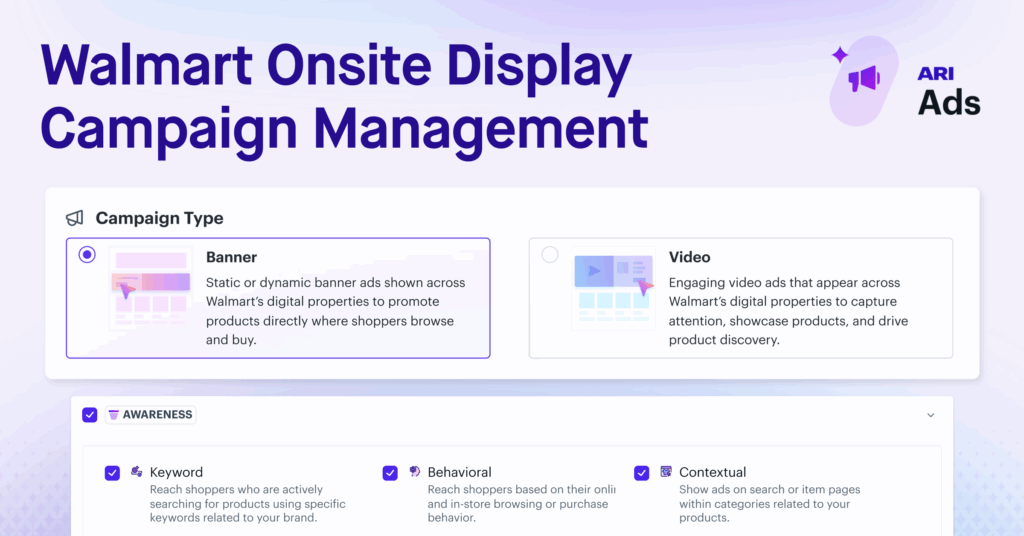

✅ Invest in advertising – With Walmart Sponsored Search and Performance Ads evolving fast, early adopters of paid media will stand out.

✅ Optimize for Walmart’s algorithm – Prioritize listing quality, inventory health, and fulfillment readiness to stay visible and buy-box competitive.

✅ Think multichannel – Walmart is just one piece of the ecommerce puzzle. Brands that balance Amazon, Walmart, and DTC will be more resilient and scalable.

In short, selling on multiple marketplaces enables you to maximize your reach and minimize your risk. It’s no surprise that as Walmart’s marketplace has risen, “multichannel” has become a buzzword among e-commerce professionals. Successful brands are increasingly those who can meet customers wherever they choose to shop – be it Amazon, Walmart, eBay, or even emerging channels like TikTok Shop.

Conclusion: Embrace the Multi-Marketplace Opportunity

Walmart’s record-setting growth in 2025 is a clear indicator that the e-commerce playing field is expanding. Amazon is no longer the only game in town. Sellers who recognize this shift and embrace a multi-marketplace strategy will be best positioned to thrive in the coming years. By diversifying your channels, you can ride Walmart’s wave of growth while maintaining your strong position on Amazon (and other platforms), creating a more robust and stable business overall .

The key is to act proactively. Walmart’s marketplace is still in a phase of rapid expansion – meaning there’s still time to establish your brand there and capture loyal customers as the platform grows. At the same time, Amazon remains a powerhouse that you likely don’t want to abandon. By strategically managing both, you can enjoy the best of both worlds: Amazon’s huge scale and Walmart’s fast-growing new audience.

Ready to expand your e-commerce reach? Chat with our experts at Teikametrics to learn how a tailored multi-marketplace strategy can accelerate your growth and safeguard your business for the future. We’re here to help you navigate the complexities of selling on Amazon, Walmart, and beyond – so you can focus on scaling your brand across all the marketplaces that matter.