Reaching the eight-figure mark on Amazon or Walmart isn’t about luck—it’s about discipline, data, and the right mix of strategy and structure. While these marketplaces open the door to millions of high-intent shoppers, they also demand relentless precision.

From shifting ad algorithms to rising CPCs and new competition every quarter, brands that grow at scale know one thing: what worked last year won’t necessarily work today.

After analyzing the performance of real brands operating at eight figures and beyond, five key strategies consistently emerged. Each offers a repeatable framework for sustainable, profitable growth.

1. Start with a Full-Funnel Foundation

Too many brands focus only on bottom-of-funnel ads—the “buy now” moments that convert but rarely scale. In fact, Amazon’s own experts note that relying solely on lower-funnel ads might boost short-term sales but causes you to miss crucial upper-funnel opportunities for brand awareness and consideration. High-performing sellers invest across the full shopper journey: awareness, consideration, conversion, and retention.

- Awareness: Use broad-reaching channels like Sponsored Brands video ads, DSP display ads, and streaming TV to introduce your brand to new audiences.

- Consideration: Leverage mid-funnel tactics such as Sponsored Display retargeting and Amazon Marketing Cloud (AMC) insights to keep your brand top-of-mind as shoppers evaluate options.

- Loyalty: Run retention campaigns (e.g. subscribe & save offers, repurchase reminders) to boost repeat purchases and lifetime value.

Case in point: Funko, the pop-culture collectibles brand, expanded its ad mix using Amazon Marketing Cloud data. By combining Sponsored Products with upper-funnel channels, Funko increased reach by 48%, total purchases by 131%, and new-to-brand buyers by 44%. The takeaway: growth caps when you only focus on conversions. A balanced full-funnel approach builds the awareness that fuels tomorrow’s sales.

2. Keep Momentum Year-Round

Seasonality is one of ecommerce’s biggest traps. Turning ads off in slower months might save budget short term—but it destroys campaign learnings and visibility, forcing you to pay more later just to regain ground.

BioLab, a pool supply brand, stayed active even in the off-season. Using Teikametrics’ Predictive AI bidding, it maintained visibility and preserved ad rank year-round—leading to a 52% YoY increase in ROAS.

Blackstone, the outdoor griddle brand, used pacing and dayparting to stretch ad budgets through slower periods, resulting in a 4x sales lift and a $43.74 ROAS.

Practical advice:

Run always-on campaigns with automation to control bids and spend. Stay visible in the off-season, and you’ll enter peak periods stronger and more profitable.

3. Target Smarter, Not Broader

Impressions don’t equal impact. As competition intensifies, precision targeting is what separates high-performing brands from wasteful ones.

DHS, a hospitality supplier, used AMC and DSP integrations to build custom and lookalike audiences that matched its highest-value customers. The result:

- +90% DSP reach

- +373% increase in new-to-brand purchases

- +100% improvement in DSP ROAS

Advice for sellers:

Use AMC overlap reports and lookalike data to pinpoint which audiences deliver incremental growth. Focus spend where intent—and profitability—is highest.

4. Structure Campaigns for Efficiency

Scaling on Amazon or Walmart without campaign discipline is a recipe for chaos. Overlapping match types, scattered ad groups, and poor budget segmentation can quietly drain thousands each month.

Igloo, the cooler brand, found its campaigns were spread too thin across match types and keywords. After restructuring in Teikametrics—separating brand vs. generic terms, removing overlap, and automating keyword targeting—it cut ad spend by 66% while increasing sales by 49% and boosting ROAS by nearly 500%.

Key lesson:

Efficient structure doesn’t limit growth—it enables it. Clean campaign architecture turns data into insight and every dollar into progress.

5. Balance Growth with Profitability

Topline revenue means nothing if margins disappear in the process. Smart brands scale within profitability guardrails—measuring performance not just by ROAS, but by contribution to overall margin.

Nutribullet, for instance, rebuilt its ad structure with clear efficiency targets for brand vs. non-brand search terms. By letting automation pace spend according to true costs and COGS—not just ad-attributed revenue—it increased sales 25% while cutting ad spend 15%.

Takeaway:

Growth should compound, not cannibalize. Set clear thresholds for ACOS and ROAS, then automate pacing to maintain profitability as competition fluctuates.

Putting It All Together

Every eight-figure brand featured in this analysis succeeded because they understood one core truth: scaling isn’t about spending more—it’s about spending smarter.

Here’s your blueprint to follow:

- Map your funnel and close the gaps between awareness and loyalty.

- Keep campaigns live all year to preserve momentum and data quality.

- Target audiences based on incremental value, not volume.

- Structure campaigns with discipline so every dollar has a defined job.

- Set profitability guardrails and automate pacing to protect margins.

The combination of full-funnel reach, year-round continuity, precision targeting, campaign discipline, and margin control creates not just growth—but sustainable growth.

Ready to Apply These Strategies?

Teikametrics helps sellers operationalize these same principles through automation, AMC insights, and cross-marketplace management. Whether you’re chasing your first eight figures or defending your category leadership, the formula is the same: data, discipline, and execution.

See how Teikametrics helps brands scale profitably →

Frequently Asked Questions

What tools can I use to automate Amazon and Walmart advertising campaigns?

Use specialized PPC management tools like Pacvue or Perpetua to automate Amazon and Walmart ad campaigns. These platforms automatically adjust bids, optimize keywords, and streamline cross-platform campaign management to boost efficiency and ROI.

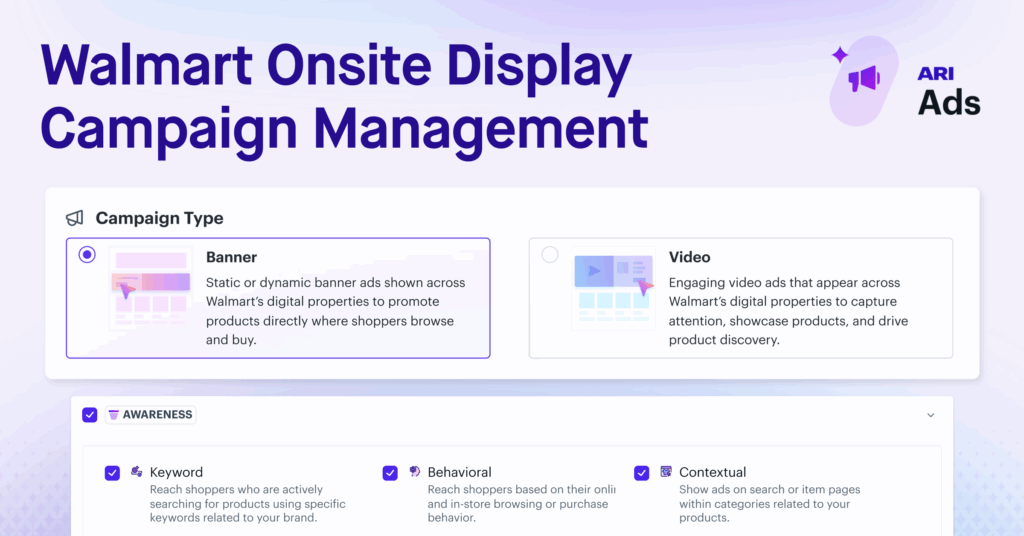

How do I implement a full-funnel advertising strategy on Amazon and Walmart?

Deploy a mix of ad types to engage shoppers at each stage of the buying journey. For example, run upper-funnel ads (like sponsored display or video campaigns) to build brand awareness and use lower-funnel ads (like sponsored product campaigns) to drive conversions.

How can I track the profitability of my Amazon and Walmart advertising campaigns?

Monitor key metrics like ACoS (Advertising Cost of Sales), TACoS (Total Advertising Cost of Sales), and ROAS (Return on Ad Spend) for each platform. These metrics show how much you’re spending on ads versus the revenue generated, helping ensure your campaigns are driving profitable growth.

What are the key differences between advertising on Amazon and Walmart?

Amazon’s ad platform provides more ad formats (Sponsored Products, Sponsored Brands, DSP) and a larger audience reach, but it also comes with heavier competition and typically higher CPCs. Walmart’s advertising platform (Walmart Connect) offers fewer ad types and a smaller (but growing) audience with less competition and generally lower costs, so you should tailor your strategy for each marketplace’s strengths.

How should I allocate my advertising budget between Amazon and Walmart?

Allocate budget based on the ROI and scale of each platform. Many sellers invest more in Amazon initially due to its larger sales volume, but also fund Walmart campaigns to capture its growth. Continuously adjust your spend split as you monitor performance on both channels to maximize overall returns.

Sources:

- Amazon Advertising – Prime Day 2025 Advanced Strategies

- Sequence Commerce – Amazon Advertising Stats 2025

- Amazon Ads Official – Full-Funnel Campaigns Guide

- Influencer Marketing Hub – Retail Media Advertising Tools

- Karooya – Amazon Match Type Campaign Strategy

- Kensium – Amazon Seller Margins Shrinking (2025)

- Jungle Scout – Benefits of Amazon PPC Software

- Aura (GoAura) – Walmart Ad Campaign Best Practices