Note: This is part 4 in a 4 part series on profitability. Read part 1 here, part 2 here, and part 3 here.

Since this is the last blog of the Profitability series, let’s refresh what we’ve learned so far. First of all, we’ve covered how money flows through your ecommerce business beginning with cash assets, converting to inventory assets that convert to sales revenue, which pay for more inventory and your profits leading back to more cash. At least that’s the goal.

We covered the fact that Cash and Profits aren’t the same and that Cash is the true measure of how your business is performing.

We’ve covered why Profits are still an important metric to monitor for these five reasons:

- To ensure you are efficiently converting sales into profit

- To build up your Owner Pay to put the proper pressure on the business for the costs of your efforts and to ensure that you and your family do not start to resent the business

- To preserve the cash to cover a rainy day and grow the business

- To create a business which is attractive to potential buyers when you want to exit

In the last blog, we introduced the five levers that you can use to improve profitability. They are:

- Revenue

- Expenses

- Receivable Days

- Inventory Days

- Payable Days

Revenue and expenses are monitored on the Profit and Loss statement and we addressed ways to improve both. In this blog, we’ll wrap up with the final three levers which are found on your balance sheet. Let’s dive in.

Lever 3: Receivable Days

The first balance sheet account to monitory is accounts receivable. The metric associated with this account is Receivable Days. In other words, how many days does it take for your suppliers to pay you after you have billed them? For many service businesses and even brick and mortar businesses, that allow customers to carry a balance, and collections can have a huge impact on their cash position.

As ecommerce sellers, this is one area that you don’t have to worry too much about. Your selling platform typically has complete control over this, and they dictate those terms. You can ensure that you understand those terms and optimize if there are any options, such a finding the lowest merchant processing fees for your platform. Monitor your storage fees if you’re on Amazon. Ensure that your listings are optimized and Amazon has the correct measurements, etc. I’ve seen many sellers being overcharged because their dimensions were correct initially, but were adjusted at some point to significantly impact their fee.

You will know with some certainty when you will receive your settlement payouts. Bear in mind that you may not receive all those funds initially as platforms typically hold back some percentage as a reserve to cover returns. We are seeing this being applied more frequently in new accounts and in accounts where there is a high volume of sales. It is typical for Amazon to hold back as much as 30% as a reserve until your next payout. Plan for this type of cash flow to ensure you will be able to meet the terms of paying your suppliers.

Lever 4: Inventory Days

You already know the importance of inventory to your business, so it should be no surprise that it is a driver for your profitability. Inventory Days is the metric that requires your attention. It monitors how many days your inventory sits in stock. The calculation is:

Inventory Value x Period Length / Cost of Goods Sold

This metric looks at how efficiently you’re converting inventory into sales. A low number of days is generally an indicator of good management. It can also be a signal that you could be subject to stock-outs. Here are some questions you can consider to help you manage your inventory carefully.

- What is your reorder frequency?

- Can you work with your suppliers to get better terms, including smaller order sizes, better prices?

- Are there hidden costs regarding shipping or customs?

- How will you handle inferior product? Shrinkage?

- Are you working together with your suppliers as partners?

- Can they offer you discounts if you pay in cash or buy in volume?

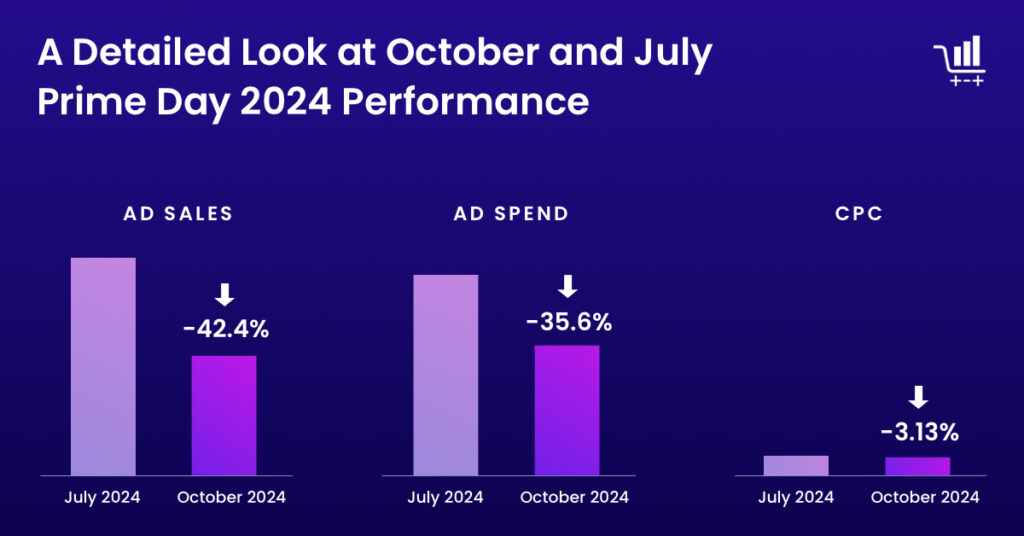

Explore every aspect of your supplier relationships to improve your inventory costs, not only for the product but for holding and carrying the inventory. Also, as I mentioned in the earlier blog, understand that your inventory levels should be impacting your advertising spend. Don’t just set up ads and then celebrate great sales until you hit a stock out. Manage those ads to impact the velocity of sales. This will improve your stock out situation and it will improve your return on ad spend.

Lever 5: Payable Days

The final lever is Payable Days. What can you do to stretch the payments to your suppliers with no penalty? Can you negotiate longer terms, adjust payments to weekly, not daily and make sure you avoid late charges? Get creative! I’ve seen clients negotiate for their manufacturer to fulfill their orders and hold them in their warehouses without payment until there is a need to send them into Amazon, and the payment is made at that time. Nice terms are out there for those that develop relationships with their suppliers!

If you must use loans to pay your supplier, be careful. There are so many options available now for loan funding that give you 60-90 days of no interest. If you’re considering these, make sure you’re using this debt wisely. Debt can be helpful if it is used as a bridge, paying for inventory knowing your settlement is coming in a few days. Debt can help if you get good terms and you have done your homework to ensure a positive return on your use of the funds.

Debt should not be used as a last-ditch effort to save the business. If you are experiencing a low gross profit margin, this is a sign that debt may be extending your business when it is not functioning well enough to cover the interest payments that will be coming due. To save your personal credit, do not take risks with debt when you are unsure of making a return.

Get Started – Pull the Levers to Profitability to Improve Your Cash

Managing all this data analysis can be a lot to address if you have many SKUs. So, I advise carving it down into manageable pieces. We work with our clients by investigating the top 20% of sales (dollars and orders) to ensure they are achieving an appropriate gross margin. If not, we start looking for areas to improve, by adjusting price, renegotiating shipping or production costs, etc. We then look at the lowest 20% of sales and see if the costs of carrying these items justify the use of our cash.

All the levers will contribute to improving your profitability and ultimately your cash flow. Before you dive in and try to do them all, look at your financials and decide which needs the most attention. Make that lever your focus for the month, and get it dialed in. Then next month, choose the next lever based on what will generate the best return for your efforts and work on that.

Too many of our clients come to us because they have gotten overwhelmed trying to do it all. Pick one, work it, then pick another, and every month your dedicated efforts will build and provide you a handsome payoff: Profits and Cash. As I mentioned in one of the earlier blogs in this series, we also work with our clients on a cash management program called Profit First. The methods of Profit First work with your natural behaviors around money to help you manage your business more successfully. The methodology uses separate bank accounts for items like Inventory, Profit, Taxes, Owner Pay and Operating expenses to give your money purpose and visibility. If you’re interested in learning more, check out my book, Profit First for Ecommerce Sellers and for more information on the financial side of your ecommerce business, check out our weekly blog at bookskeep.com.