By John Shea, Teikametrics’ Chief Growth Officer

Nike’s decision to stop selling its products on Amazon has sparked a wave of news reports, with the Motley Fool warning Nike’s move could be “the beginning of a revolt” by major brands, and former AOL chief executive Tim Armstrong telling CNBC that Nike was just the “tip of the iceberg.” The company’s exit will spark a direct-to-consumer “megatrend,” Armstrong predicts, with other brands rushing to cancel their Amazon accounts and start selling on their own websites.

Well, maybe — but let’s take a deeper look. The truth is that Nike’s exit has been a long time coming, and likely isn’t the final word in the two brands’ tempestuous relationship. This is less a messy divorce than a trial separation: one more blip in a marriage that’s already had more than its share of ups and downs.

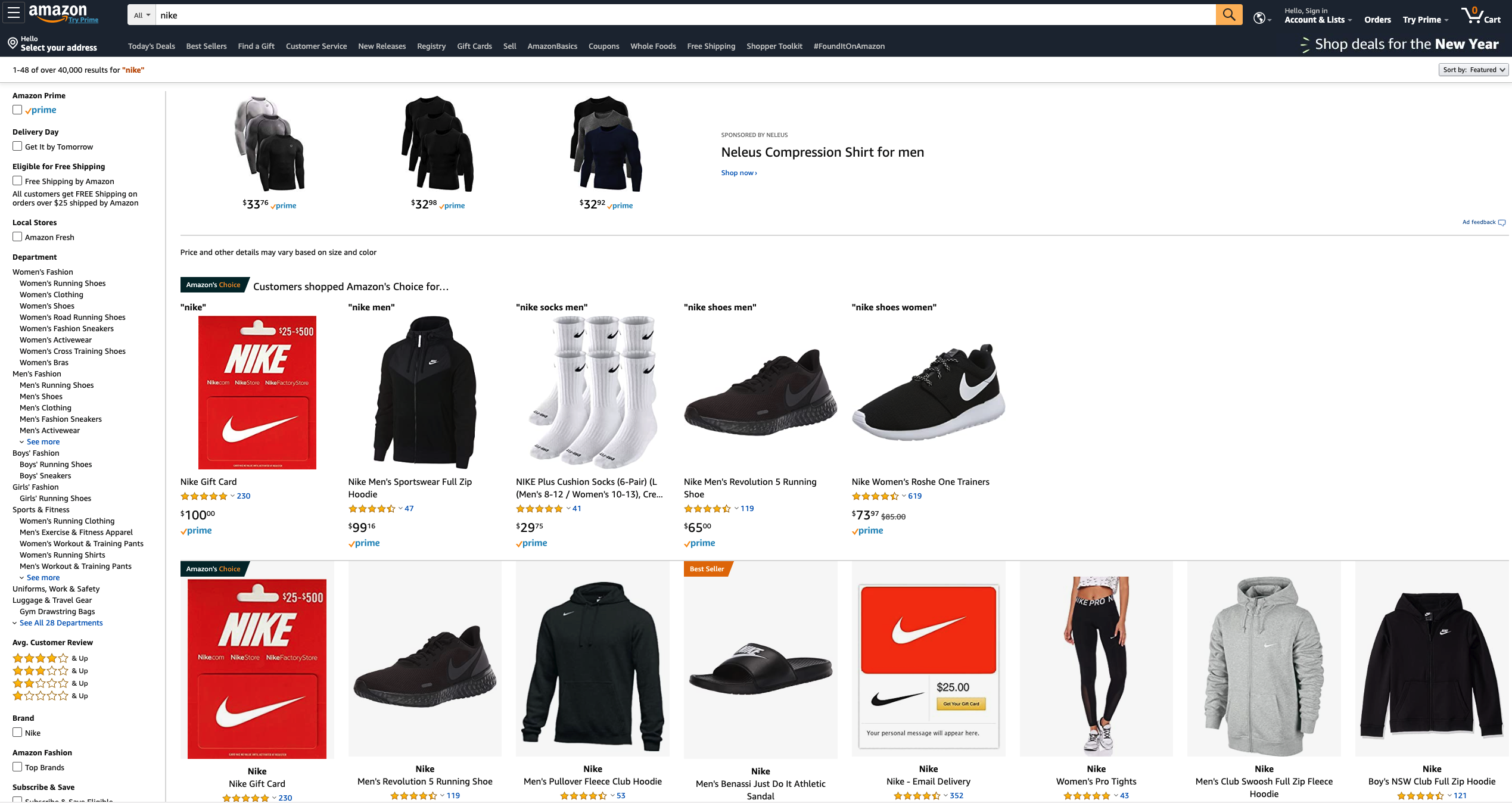

One sign that Nike’s departure isn’t the harbinger of doom that’s been predicted: type “Nike” into Amazon’s search box and you’ll still find more than 7,000 products. True, none are being sold direct by Nike – they’re being sold by “grey market” resellers instead – but for all but the pickiest and most plugged-in of Amazon users, reports of Nike’s disappearance have been greatly exaggerated.

Remember, too, that the very things that make Nike’s departure a blow for Amazon also make it hard for other brands to emulate. Nike has a huge, fiercely loyal following: plenty of sneaker-heads and sports fans will follow Nike to other retail sites, or to Nike’s own e-commerce and real-world retail outlets. And of course, Nike still makes money every time most of those 7,000 grey-market products are sold – they just have less control over the placement and the pricing.

Companies that don’t have such a powerful brand will find it harder to walk away from Amazon. If you’re buying Air Jordans, you’re probably only interested in Air Jordans — but if you’re buying phone chargers or printer paper, you won’t click away from Amazon in search of a specific brand.

That’s not to say Amazon isn’t reeling from Nike’s departure. Even for a business of Amazon’s size, losing a giant like Nike is a big deal. The e-commerce giant has been making advertising a key part of its business model in recent months, and to keep that snowball rolling and growing, Amazon needs big brands to spend big bucks on coveted Suggested Product placements and other promotions. Nike’s disappearance will put a dent in the sales pipeline of a few of Amazon’s ad-sales reps, but they won’t lose too much sleep — too many other major brands are increasing their spend as the third-largest ad network grows at an unprecedented rate.

Nike has also given plenty up by walking away from Amazon’s marketplace. Nike’s relationship with Amazon was always, in part, an attempt to pressure Amazon to rein in grey-market resellers and help Nike claw back control of its brand. By walking away, Nike gives up its leverage, and also forfeits the chance to use its colossal marketing budget to buy up ads and drown out rival resellers.

So where do Nike and Amazon go from here? Well, Nike will flirt with a few other potential retail partners — though it won’t find any with Amazon’s reach. Nike will also use its vast heaps of marketing cash to build brand loyalty and emphasize the quality of genuine Nike products.

In the meantime, like a spouse who’s come home to find their partner has cleaned out their closet and checked into a hotel, Amazon has some serious thinking to do. Nike left because Amazon put its countless resellers ahead of its big-brand partners – and if that’s really where Amazon’s priorities lie, then further problems do lie in store.

What’s more likely, though, is that Amazon and Nike will eventually strike a deal to give Nike more control over what’s sold on Amazon, in exchange for which Amazon will get both Nike’s blessing and its ad spending. It might take some time — and some painful compromises on both sides – to smooth things out. But despite its ups and downs, this relationship isn’t over yet.