Differences Between Amazon and Walmart

When you’re expanding your business from Amazon to Walmart, it’s helpful to understand the differences between Amazon’s and Walmart’s advertising capabilities.

Some ad strategies can be successfully ported from Amazon to Walmart, but it’s not true across the board. Plenty of strategies that may be effective on Amazon can be quite wasteful on Walmart. However, there are also opportunities on Walmart that don’t exist on Amazon at all.

Prefer to learn by watching video? Check out The Key Differences Between Selling & Advertising On Amazon Vs. Walmart

Three Areas of Contrast

The differences between Walmart and Amazon search advertising can be categorized into three areas:

- Platform Differences

- Optimization Differences

- Reporting Differences

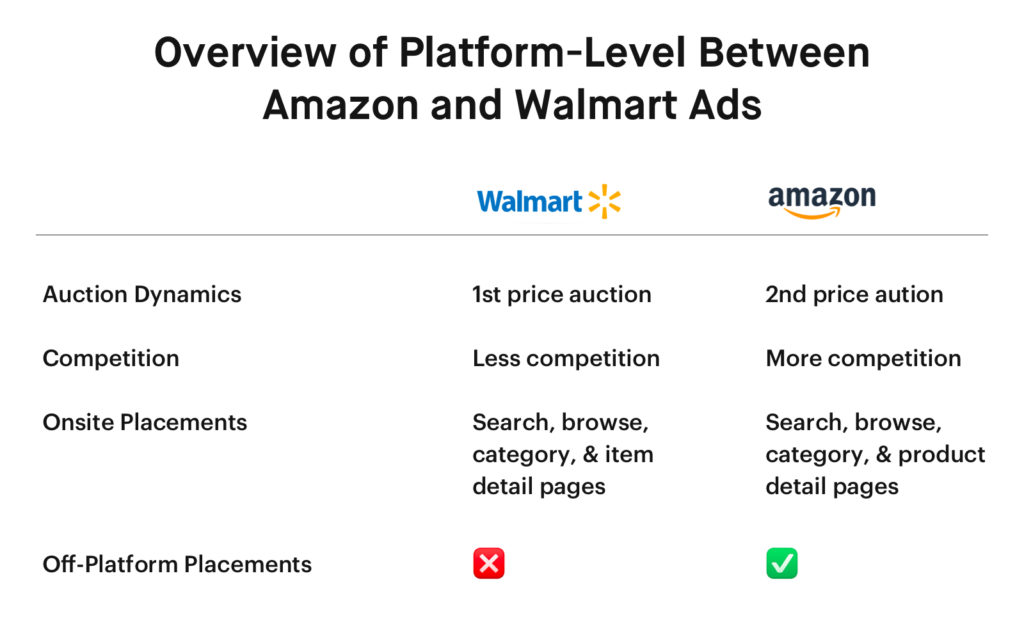

At the platform level, there are important variances around auction dynamics, competition, and ad placement.

In terms of opportunities for optimization, differences abound, including item-level bidding, targeting types available, the option to utilize bid multipliers, and more.

And at the reporting level, we find more granular performance reports on Walmart as compared to Amazon.

Let’s break down each of these differences and what they mean for sellers on the Walmart marketplace.

Platform Level Differences

At the platform level, I’ll start off by diving into the differences in auction dynamics because this is foundational to how all of advertising works on Walmart and Amazon.

Auction Dynamics

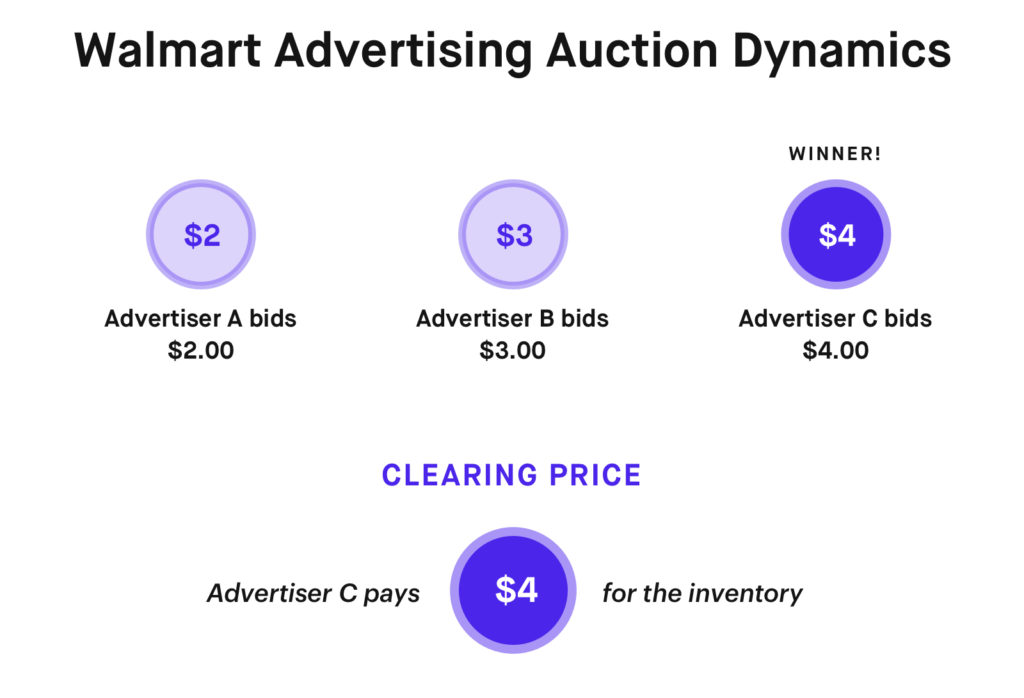

While Amazon utilizes a second price auction, Walmart adopts a first price auction. This has major implications for your budget and bidding strategy.

The first price auction means the seller with the highest bid wins the auction and pays the amount they bid on a particular item/keyword. For every click that Walmart drives through sponsored ads, the seller pays exactly what they bid for.

In a second-price auction, what the winner pays is one cent higher than the second-highest bidder.

Because the auction dynamics are completely different between Amazon and Walmart, handling advertising campaigns efficiently requires different tactics. With Amazon ads, you can look at your CPC to help estimate how far above your bid the auction winner is, and then place your bid accordingly.

But in a first price auction, because you don’t have any way to determine how far or near the second-highest bidder is, it becomes very difficult to pick the right bid for your item or keyword.

This is why I recommend adopting a conservative bidding strategy to ensure you are not overpaying for Walmart search clicks. The guidance would be to start with a $0.20 bid on auto campaigns and $0.30 on keyword campaigns, and then do upward bid exploration to identify the most valuable bid. This strategy will ensure you are paying Walmart the real value of the click and not blowing away your ad budget inefficiently.

Low Competition

Another difference between Amazon and Walmart is the degree of competition. Walmart Sponsored Products was launched in 2019, so it’s been around for about three years and has a relatively lower number of sellers taking advantage compared to Amazon search. That means there’s lower competition for search ad space than on Amazon.

A seller in a highly competitive category on Amazon might need to bid three to five dollars to win ad slots. The CPCs are driven up by the willingness of the competition to spend to attain these coveted placements. In the same category on Walmart, the same seller might be able to win ad slots for about a dollar, because there is much less competition to drive up the cost.

So at very low bids, a seller can win ad slots on Walmart thanks to the lower level of competition there. This means there’s a world of opportunity for incremental growth on Walmart. Amazon is a game of volume and scale while Walmart is a game of profitability.

Ad Inventory & Placements

Both platforms offer a robust selection of CPC-type ads to promote products. These ads enable premium placements in search, browse, category, and item pages, allowing sellers and brands to reach customers throughout their shopping journey. Ad inventory on Walmart is differentiated by targeting type. Auto targeting campaigns on Walmart are eligible to win all available placements while manual targeting campaigns can render ads only in search in grid and carousel placements on search pages. Amazon does not differentiate ad inventory based on campaign targeting types.

Unlike Amazon which offers DSP advertising, Walmart does not offer off-site advertising placements.

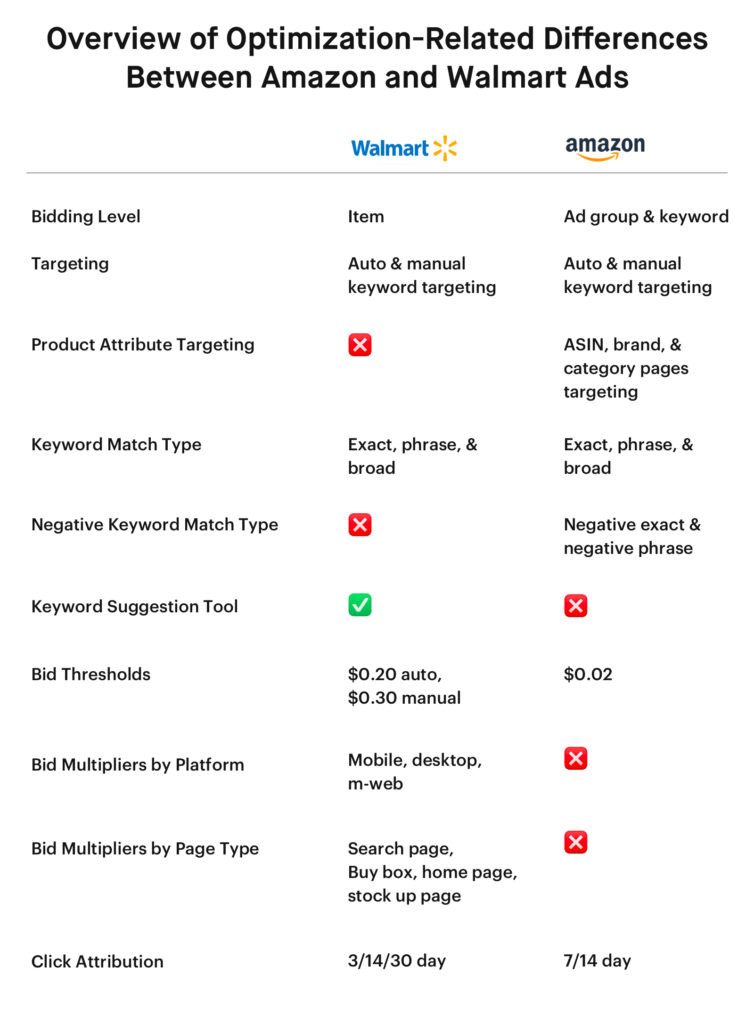

Optimization Related Differences

While Amazon’s targeting capabilities are extensive, the Walmart platform provides more granular controls and visibility to optimize your advertising campaigns for better performance.

Item Level Bidding

One of the key controls on Walmart is the ability to bid at an item level on auto targeting campaigns instead of an ad group level. This gives you much tighter control when managing the performance of auto campaigns.

Targeting Types

Amazon and Walmart both offer keyword targeting. Like Amazon, Walmart has both auto and manual keyword targeting and it’s beneficial to utilize both.

Walmart, however, does not offer Product Attribute Targeting, a capability Amazon does have.

Keywords

Walmart is unique in offering a keyword suggestion tool. Amazon has something similar but it requires going into the Amazon campaign manager to find the Amazon recommended keywords, rather than functioning as a stand-alone tool.

Walmart also lacks the negative keyword match type that Amazon has. Negative keywords can help to cut down on ad spend on Amazon.

Minimum Bid Thresholds

Minimum bid thresholds are different on Walmart than they are on Amazon. Walmart requires a bid of at least $0.20 for auto campaigns and at least $0.30 for manual campaigns, whereas on Amazon these minimum bid amounts are much lower.

Bid Multipliers

Walmart provides bid multipliers to be able to maximize the performance on platforms (e.g. mobile app) and page types (e.g. Walmart home page) where your ads are performing well. This allows you to get your ads more exposure when you’re seeing great results.

Attribution Window

In terms of attribution for reporting, Amazon adopts a 7 and 14-day click attribution whereas Walmart provides data at 3-, 14-, and 30-day attribution windows. The default attribution reporting window on Walmart is the 14-day click attribution.

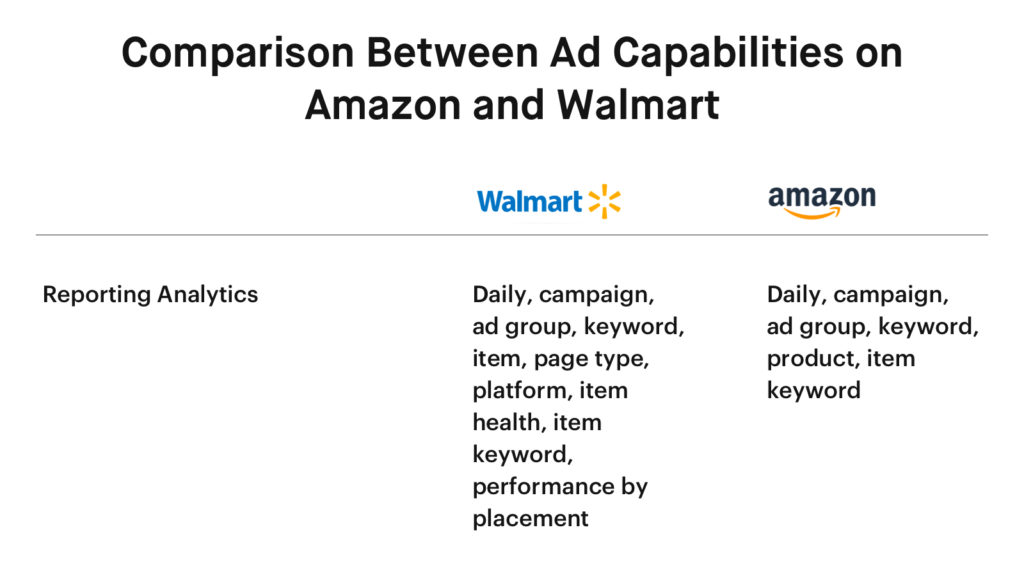

Reporting Differences

On the reporting front, both marketplaces offer reporting dashboards with key performance metrics for advertisers, on the keyword, brand, and item level.

Walmart provides more granular reporting to be able to influence your ad strategy to maximize performance.

Ad performance reports available from Amazon and Walmart:

- daily performance

- campaign performance

- ad group performance

- keyword performance

- item/product performance

- item keyword performance

Ad performance reports available only from Walmart:

- page type performance

- platform performance

- item health performance

- placement performance

Platform-Level Performance Reporting

Platform-level performance is something that Walmart provides which is not available on Amazon. Walmart provides you with a view of how many customers are coming through the mobile app, the desktop site, and mobile Web.

Based on these insights, you can decide to reallocate spend from Walmart platforms that aren’t resulting in a high volume of sales toward ones which are performing well.

Overview of Reporting Differences Between Amazon and Walmart Ads

To Recap

To make your advertising efforts across both marketplaces as successful as possible, it’s critical to understand the differences between Amazon and Walmart ads at the platform, optimization, and reporting levels.

Despite these differences, the marketplaces also have many features in common. Premium sponsored placements with keyword targeting and reporting dashboards, along with API availability means partner companies like Teikametrics can automate ad optimization to drive results.

Teikametrics can optimize your ads on Walmart and Amazon, but our automated bidder for Walmart is developed for the unique Walmart ad system and the idiosyncrasies that contrast it from other marketplaces. This ensures your ads get you the best return on your ad spend, on each retail site.