This blog post is part 1 of 3 of an ongoing Prime Day 2019 analysis. Check in soon for our Health & Household and Home & Kitchen breakdowns coming soon in October!

Key Teika-Way

For products in the ‘Clothing, Shoes, and Jewelry’ category on Amazon, Prime Day 2019 was categorized by a massive increase in the sheer volume of activity, rather than a marked change in shopper behavior from a click-frequency or conversion rate perspective.

What You’ll Find in the Report

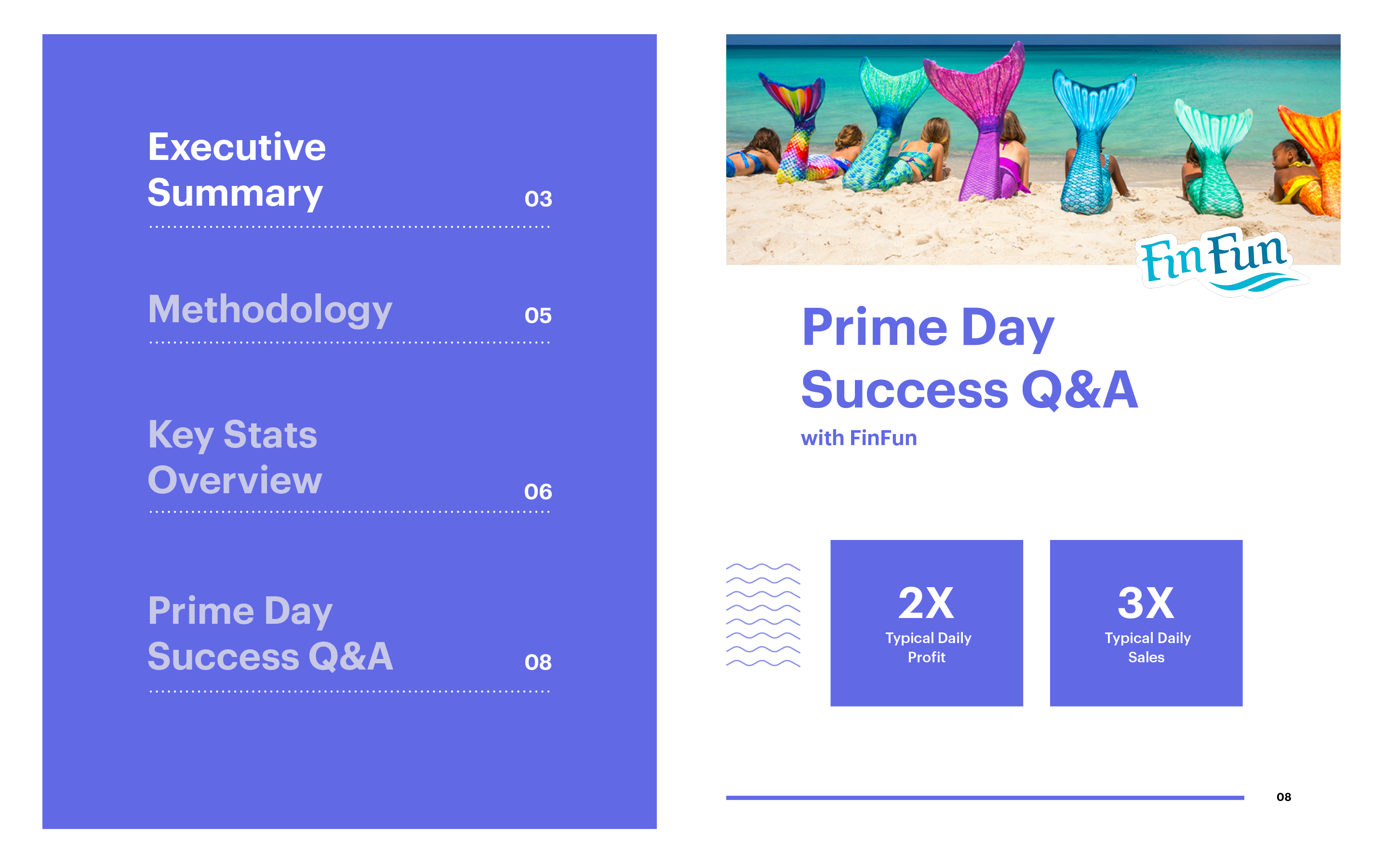

The report details aggregated key performance metrics changes including average CPC, conversion rates, revenue, ad spend, ACoS, and TACoS. Additionally, we interviewed a successful clothing and novelty brand, Fin Fun, to understand their unique goals, strategies, expectations, and results for this year’s Prime Day.

Methodology

The data outlined in this study is reflective of sales and advertising activity across more than 1,500 products sold by Teikametrics clients in the ‘Clothing Shoes & Jewelry’ category on Amazon. Metrics utilized within the analysis include organic sales, ad-derived sales, ad spend, and ad clicks. Our data science team designed a comparative analysis of Prime Day (July 15th & 16th 2019) vs. the four Mondays and Tuesdays prior to Prime Day. Specifically, these ‘non-Prime Day’ dates were averages across June 17th, 18th, 24th, and 25th, along with July 1st, 2nd, 8th , and 9th.

Please enjoy our Prime Day 2019 ‘Clothing, Shoes, and Jewelry’ deep dive. You can sign up to review the report by clicking the button below: