While Amazon search and purchase activity is certain to rise during Cyber Week, different categories will see varying degrees of lift. For sellers and brand owners, preparing for how your specific category is likely to trend will help set a more effective strategy, budget, and realistic forecast as we approach this all-important time of year.

A category-level analysis by the Teikametrics data science team across our Amazon seller base during Cyber Week 2019 demonstrates some interesting findings that should help better guide your baseline expectations for Cyber Week 2020.

Not All Categories Should Expect the Same Gains During Cyber Week

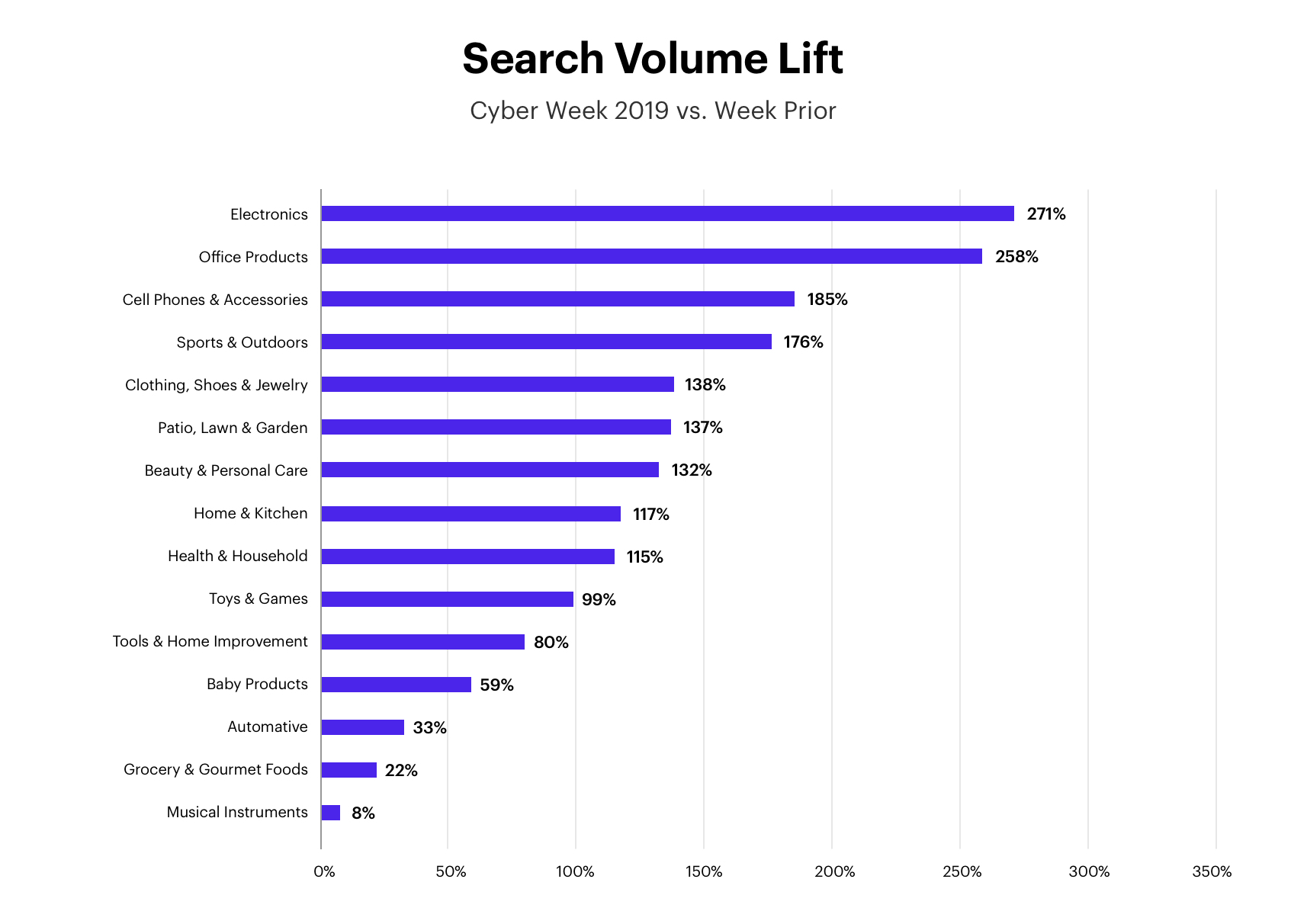

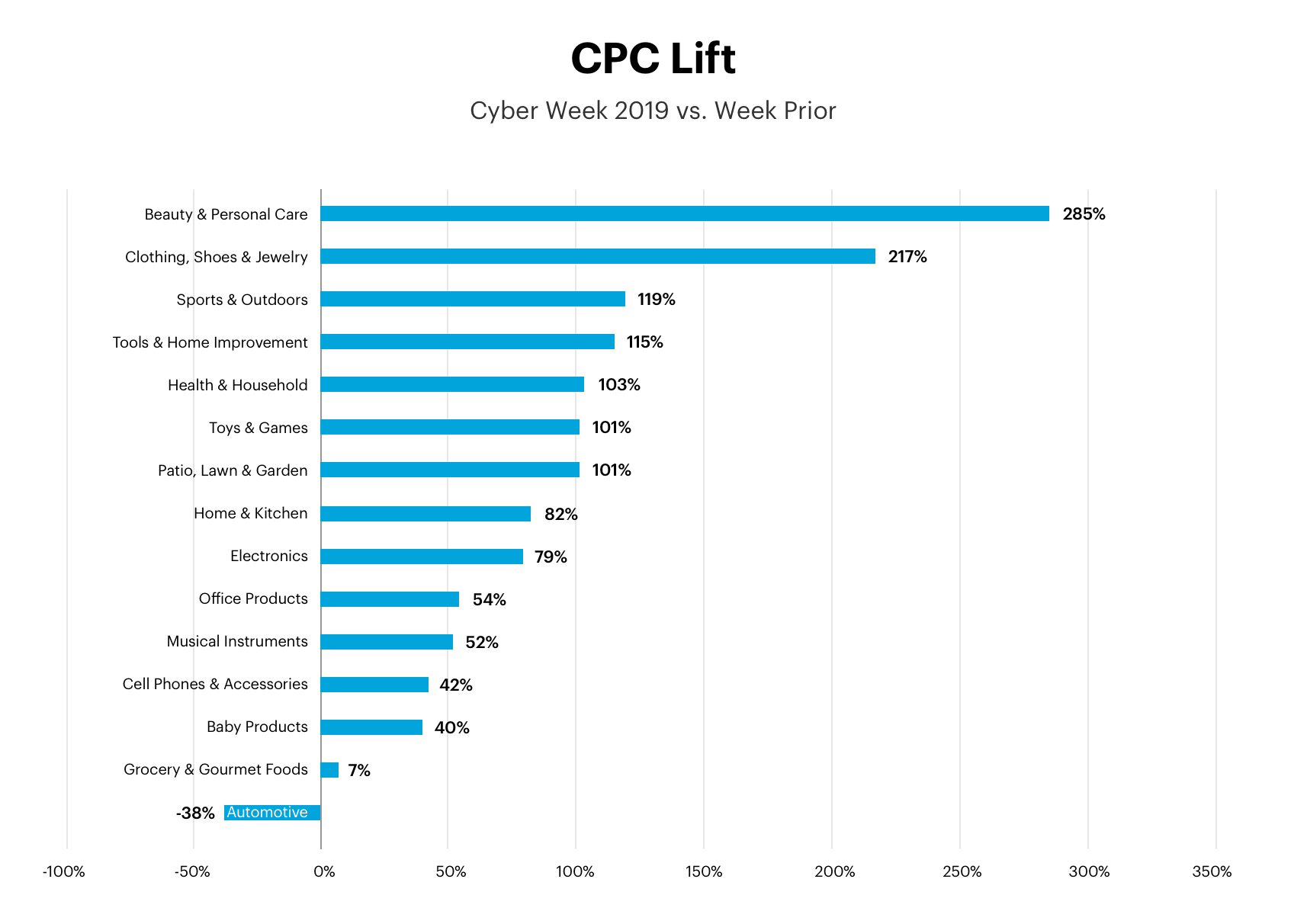

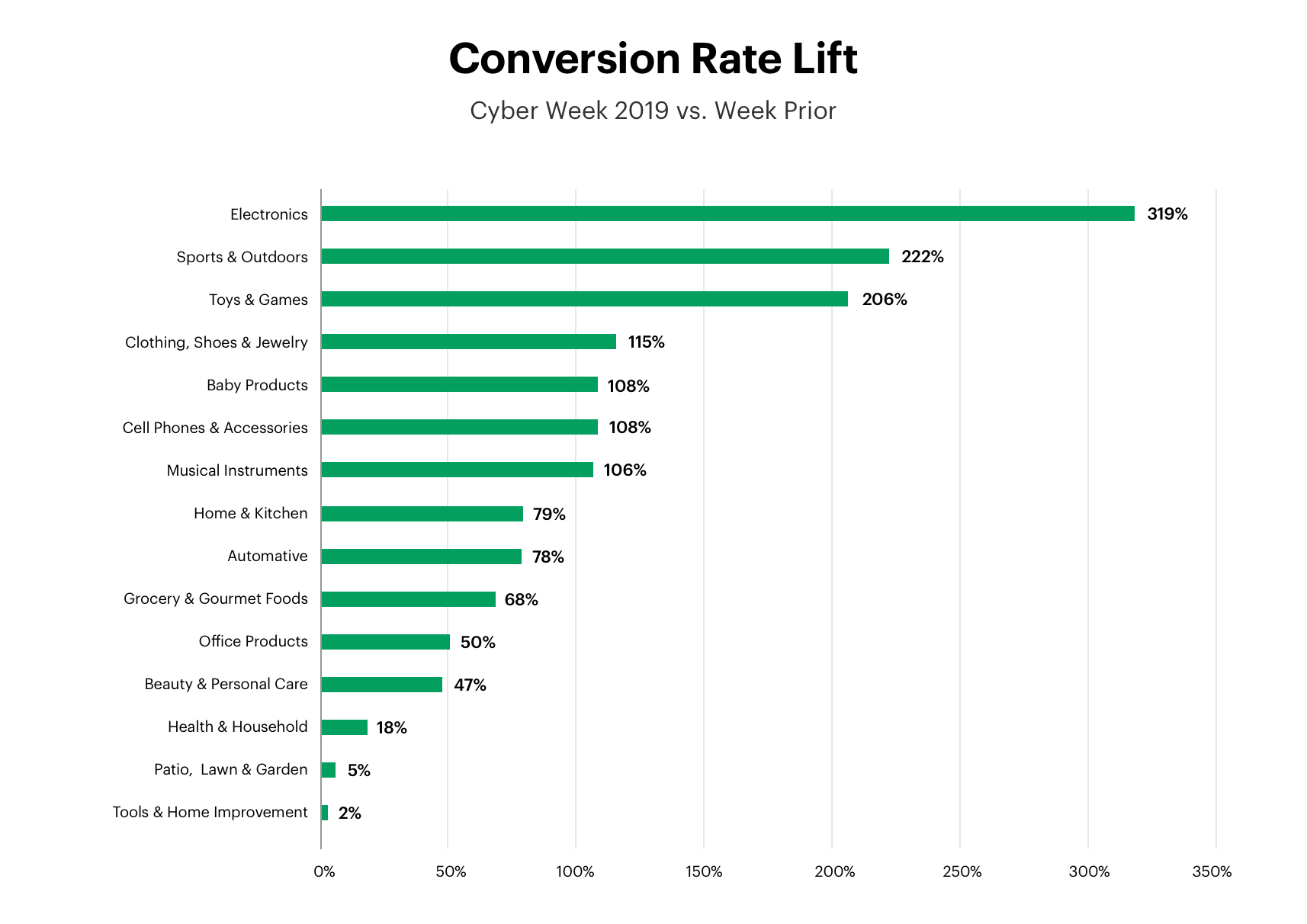

While nearly all major categories saw search volume increases during Cyber Week compared to the prior week, individual category fortunes varied widely from single-digit percentage increases, to more than 200% increases. Conversion rate and CPC differences on Sponsored Ads were similarly stark. Multiple categories experienced conversion rates and CPCs rising by triple-digit percentages, while others saw single- or mid-double digit increases.

Categories most associated with deal-seeking or gift-giving, including Electronics, Sports & Outdoors, and Toys & Games, experienced both substantial search volume increases, along with similarly large boosts in conversion rates compared with prior weeks. An overall uptick to Amazon site activity over Cyber Week meant that categories more associated with commodity products like Grocery & Gourmet Food and Health & Household, still saw rising search volume and conversion rates. However, those increases were dwarfed by the improvements seen across those higher consideration categories listed earlier.

What This Means For Sellers And Brand Owners As We Approach Cyber Week 2020

- There is real potential for efficient conversions due to increased activity around Cyber Week, particularly across high-performing verticals

- In order to recognize increases in activity as they happen and adjust bids accordingly, it’s critical to have bidding technology that takes seasonal conversion rate changes into account

- CPCs generally go up across verticals during Cyber Week, with advertiser demand outstripping the increase in consumer activity

- The corresponding boost in conversion rates means these more expensive clicks may be well worth the cost. Be sure you have a good accounting of your COGS and MACS so you can confidently bid to value.

We’ll publish subsequent analyses in the leadup to Cyber Week, along with data on what happened during Cyber Week 2020 after the sales event concludes on December 1st.

Looking for more data analyses from the Teikametrics Data Science team? Check out all the Teika AI studies here!

Teikametrics’ Data Science Team Mission

The use of machine learning technology is largely restricted to companies with incredible resources at their disposal. Teikametrics’ Data Science team aims to democratize the power of AI-backed decision making for ecommerce businesses by providing brand owners and sellers around the globe with transparent and understandable data-driven insights, recommendations, or actions.

Methodology

As a note on methodology, each ad group across the Teikametrics database from 2019 was attached to one or more product categories based on the underlying ASINs within the ad group. As baselines, daily averages within product categories were computed over the periods 10/31/2019-11/06/2019 and 11/21/2019-11/27/2019. These baseline average metrics were then compared to the corresponding category-wide metrics for Cyber Week starting on Thanksgiving, 11/28/2019, and continuing through Tuesday 12/02/2019.