Proper inventory management for Amazon is more important than ever this Q4. With multiple sale events so close together, and the potential for further pandemic-related impacts to fulfillment, a miscalculation now will cost you dearly during this all-important time of year.

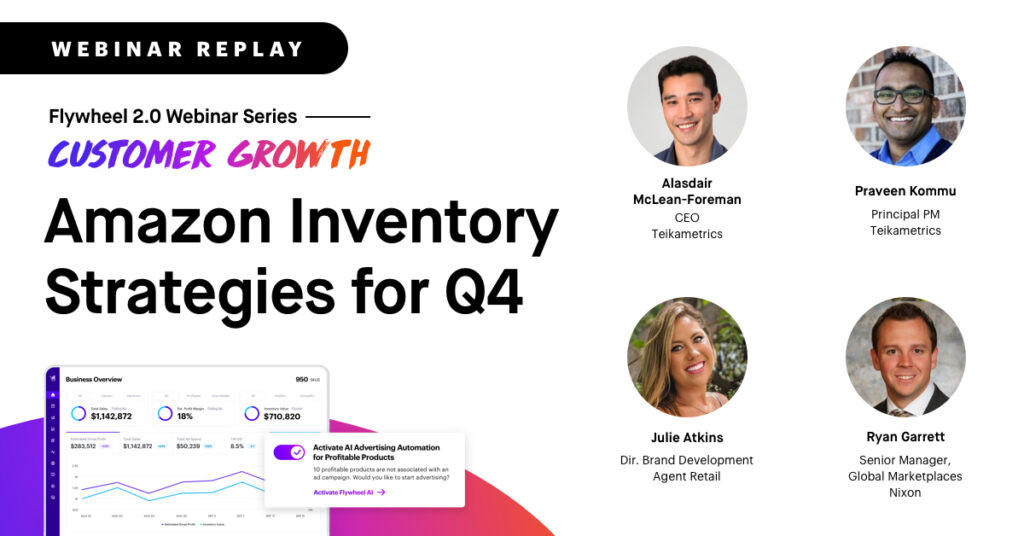

Teikametrics CEO Alasdair McLean-Foreman and Principal Product Manager Praveen Kommu held a deep discussion with industry-leading sellers on critical metrics to track, how they are getting their inventory operations ready for Q4, and tips on aligning your inventory strategy with other aspects of your Amazon presence.

Use the timestamps below to skip to the topics that matter most for your business, or scroll to the bottom to watch the complete webinar replay.

The speakers:

Alasdair McLean-Foreman

Alasdair McLean-Foreman

CEO, Teikametrics

Praveen Kommu

Praveen Kommu

Principal PM, Teikametrics

Ryan Garrett

Ryan Garrett

Sr. Manager, Global Marketplaces at Nixon

Julie Atkins

Julie Atkins

Dir. Brand Development at AgentRetail

Some background on our guest speakers for this event:

Julie Atkins is Director of Brand Development at AgentRetail, a multi-million dollar Amazon investment portfolio operating over 100+ world-class brands in the outdoor, apparel, and household categories. Julie started operating brands on Amazon in 2012 and has sold more than $100 million via Amazon.

Julie Atkins is Director of Brand Development at AgentRetail, a multi-million dollar Amazon investment portfolio operating over 100+ world-class brands in the outdoor, apparel, and household categories. Julie started operating brands on Amazon in 2012 and has sold more than $100 million via Amazon.

Ryan Garrett is Senior Manager of Global Marketplaces at Nixon. He founded and operated a full-service logistics company for Amazon sellers, assisting thousands of companies with supply chain and inventory management. Ryan works with brands to establish and train internal cross-functional teams to operate on global marketplaces

Ryan Garrett is Senior Manager of Global Marketplaces at Nixon. He founded and operated a full-service logistics company for Amazon sellers, assisting thousands of companies with supply chain and inventory management. Ryan works with brands to establish and train internal cross-functional teams to operate on global marketplaces

Topics we cover:

- Common inventory inefficiencies brands face in uncertain times

- Risks and opportunities associated with an unusual Q4, and choices that will impact Q1

- Amazon’s Inventory Performance Index and brand perspectives on using that metric effectively

- How to calculate Inventory Turn Ratio and how brands understand its impact on the bottom line

Timestamps:

Use the timestamp links to skip to the topics that are most relevant to your business.

[1:17]

[1:17]

Meet the stellar lineup of panelists

[3:23]

[3:23]

Our CEO Alasdair McLean-Foreman tells the story of Teikametrics, Flywheel, and now Flywheel 2.0

[6:28]

[6:28]

The agenda for this webinar: inventory optimization, expectations for Q4, Amazon IPI, and the inventory and profitability correlation

[8:09]

[8:09]

Alasdair explains the need to use powerful technology to run a tight ship

[10:18]

[10:18]

Andrew Waber, Director of Insights at Teikametrics, lays out uncertainties and opportunities for Q4 2020

[13:32]

[13:32]

Julie Atkins explains how not having months to plan for a known Prime Day date affects inventory management and pricing

[18:56]

[18:56]

Ryan Garrett describes crafting Prime Day sales based on what products happened to be in stock and adjusting plans to maintain inventory when Amazon sets limits on receiving products

[24:32 ]

[24:32 ]

Praveen Kommu, Principal Product Manager at Teikametrics, breaks down Amazon’s Inventory Performance Index (IPI) — a scorecard of Amazon’s perception of your inventory management — as well as the consequences of a low IPI score

[30:24]

[30:24]

Julie says, when managing IPI look at listing optimization, competitive pricing, and disposal or outlet sales to get rid of just a couple of remaining items in stock

[34:18]

[34:18]

Ryan says, Nixon watches IPI closely to plan inventory operations and they’ve been testing out Amazon’s virtual bundles to get rid of excess inventory

[38:14]

[38:14]

Alasdair and Praveen tag-team on what Jeff Bezos doesn’t want you to understand about your true profitability, but how calculating Inventory Turns can get you there

[44:28]

[44:28]

Amazon’s Inventory Management screen spreads the data across multiple places and doesn’t include COGS — Flywheel 2.0 will put all the inventory optimization data you need in one screen

[55:18]

[55:18]

Inventory optimization is just one portion of Flywheel 2.0, which is open for requests for early access

[57:00]

[57:00]

Q&A with the questions other sellers are asking about inventory optimization

Watch the replay:

Read the full transcript:

Andrew Waber (00:00:03):

Hello everyone. Welcome to another Teikametrics Webinar. Very excited for this one, excited for you to join us. So today, this is the first in our ongoing series entitled Customer Growth, which is part of this Flywheel 2.0 Webinar Series. And specifically today, we’re going to be talking about Amazon Inventory Strategies for Q4. And so there’s a lot to cover here, we have some just terrific guests that we’re really happy to be joining us here. So just a few housekeeping notes before we get started. Just as a note you, will receive a recording of this webinar, a full video recording, along with the slide deck, after roughly 24 hours following the presentation. There’ll be some other materials in there for you as well so just look out for that in your email. And additionally, and I’ll mention this once again, but at any point during the presentation if you have a question, feel free to enter it in that question box off on the right hand side of your screen and we’ll get to as many of those towards the end of the presentation as we can. But again, you don’t have to wait till the end to ask those questions, if one comes up during the course of their presentation, please feel free to pop it in there.

Andrew Waber (00:01:16):

So with that let’s get to our speakers. So first from the Teikametrics side really, really happy to be joined by Alasdair McLean-Foreman, who’s our CEO and he’s actually one of the first Amazon 3P sellers in 2003, way back in the day. And with us, also from the Teikametrics side is Praveen. He’s a principal PM for Teikametrics and he’s really been just living and breathing inventory for the past several months and he also, previous to that, worked at Amazon as a Senior PM as well. And with us, very distinguished guests really happy to be here is Julie Atkins, along with Ryan Garrett. So with that, Julie I’d like to pass it over you just talk a little bit about yourself.

Julie Atkins (00:02:03):

Yeah. So I started selling on Amazon back in 2012. And I work for AgentRetail, so we partner with brands to help promote them on Amazon, align them with their marketing and amplify their sales. So we work with a variety of different categories and really excited to be joining today to discuss how we optimize our inventory.

Andrew Waber (00:02:32):

Great, thanks a lot Julie. And Ryan, over to you just tell us a little about yourself and your experience.

Ryan Garrett (00:02:38):

Yeah. So similar to Julie, I actually also started selling on Amazon in 2012, and that led me to found an Amazon-focused 3PL where we handled end-to-end logistics for Amazon sellers. Had a few thousand clients and so I’ve seen a lot of inventory and worked in a lot of different warehouses. Now I’m with Nixon, I’m working with them to build a cross-functional team to manage their global marketplaces to run mostly on Amazon but also on Walmart, Tmall et cetera across the globe.

Andrew Waber (00:03:12):

Great, thanks so much Ryan. So Alasdair, if you don’t mind, maybe talk a little bit about kind of the overall ethos of what we’re doing here.

Alasdair McLean-Foreman (00:03:23):

Thank you and thank you very much Andrew and also I just want to say thank you to all of the audience, I really appreciate the opportunity to put on this content for you. This is a very interesting but exciting time for ecommerce, and we’re going to do our best to give you some exciting content. And it is something that I’m super passionate about. I was one of the first third party sellers back in 2003, believe it or not. And since then, I have started this company Teikametrics and here we have an obsession to build tools to help sellers and brand owners, and this has been an interesting evolution. We started with the first machine learning and AI powered tool for Amazon Advertising, called Sponsored Product Optimizer in 2018. We saw tremendous growth and we’ve helped thousands of sellers improve their ads. In 2019, we released a new tool called Flywheel, and what we wanted to do is bring context of inventory and actually profitability to the advertising data and the advertising performance.

Alasdair McLean-Foreman (00:04:30):

I’m really excited to do this presentation today because we’re going to be sharing some new things and it’s around our new product called Flywheel 2.0. And as you can see in this diagram, what we’re going to be doing with Flywheel 2.0 is actually bringing more functions more solutions to the table in one holistic platform. And that’s one of our visions we are planning to pull in technology around market intelligence, inventory optimization, which is what we’re talking about today, preferred financing actually giving sellers and brand owners the essential fuel to grow their businesses, multi-channel, as things become more complicated, and of course, that key piece that we do very well with today which is Amazon Advertising Optimization. So super excited to… And thank you Julie and thank you Ryan for coming on board with us for this content. Super excited to hear and just share some of these new things that we’re building for our customers.

Andrew Waber (00:05:34):

Great thanks, so much Alasdair. So just a quick note, kind of on this Customer Growth Series as a whole, and you’ll see this again we’re going to be doing more of these webinars kind of over the next several months. Really, the point is to get everyone here, all the attendees, kind of in touch with real stories when it comes from sellers dealing with the problems that that Alasdair was talking about, that Flywheel 2.0 is going to address. And so it’s about sharing those stories, about understanding what are the best practices, how they work through challenges, and the goal is that for you, as a listener coming in, that you get kind of two takeaways, right? One would be right as you kind of come out, what’s right in front of you and how are you going to address those issues? And thinking more long-term about your presence on ecommerce marketplaces. What’s going to put you in the best long-term position? So you really should get kind of both sides of that story throughout this series.

Andrew Waber (00:06:28):

And so just a quick note on our agenda, what we’re going to be covering today. So first, we’re going to be talking about inventory optimization and specifically good tips that you can use in terms of success. What’s really kind of from a high level, what are going to be some good things that you can take away from this that’s going to put you in a better position? And kind of, I’m going to be talking about expectations around Q4 2020 based on some market trends that we’ve seen recently on the data side. And then Praveen’s going to jump in with an overview of Amazon IPI, if you’re familiar with that, he’ll go into kind of what constitutes Amazon IPI, why it matters and how to manage it obviously we’ll be putting out to the panel there in terms of ways they’ve used this within their own operations. Then the last piece of kind of meaty content in here, we’re going to be talking about inventory and profitability, right, how those things interact and what you should be paying attention to in terms of growing your own business when you’re thinking about these two different metrics. And then finally we’ll wrap up with some Q&A.

Andrew Waber (00:07:34):

Again, just to reiterate for anyone that came in late, if at any point during this conversation, you feel a question come up, pop it into that question box on the right hand side of your screen, we’ll get to it again as soon as we can kind of at the end of the webinar as part of that Q&A, so just keep that in mind. And additionally just to reiterate you will get a recording of this presentation within 24 hours after this conclusion. So if you missed something, don’t worry you will get a chance to hear it again. So with that, I’d love to pass it over to Alasdair.

Alasdair McLean-Foreman (00:08:11):

Thank you Andrew. This is an interesting slide and it’s obviously a visual slide. So on the left here we have a powerful power boat planing through the water efficiently, looks very modern very sleek. On the right hand side of course we’ve got this sort of raggedy old vessel that looks like it’s about to go under. And what I wanted to share for the audience is thinking about this classic concept of running a tight ship. Focusing on building a business that’s extremely well maintained, extremely precise, powerful and focused and you know that’s what you all should be building, that image on the left hand side. And you’ve got to think about what processes, what level of discipline, what tools, what technology? If you’re using the boat analogy you want to put in the biggest motor, you want to put in GPS or RADAR that’s going to navigate you through the treacherous waters in the most efficient and safe way. And as a business operator, it’s your job to think about captaining the ship but also building the systems around that vessel as well.

Alasdair McLean-Foreman (00:09:25):

So we wanted to put this image up as we go through some of these components, we see thousands and thousands of sellers and I’ve been very fortunate to build a company that has helped many sellers. And as we’ve looked at which types of companies perform the best, it’s the ones that have that disciplined obsession. It is almost quite boring, it’s a weekly process, a daily process, perhaps a quarterly process, where they’re extremely disciplined operators. And this is a great segue over to some of our guests, both of which have had tremendous success, and I would say are in that category of the top one percent of Amazon operators. So let’s think about that as we go through the content.

Andrew Waber (00:10:15):

Great, thanks Alasdair. And just to kind of kick things off, I think we should really talk about what’s going to be different, this Q4 in particular. And again, my name is Andrew Waber, I’m the Director of Insights over here at Teikametrics and obviously some of these things are more part of what all of us as sellers are going through, but also I can kind of talk through what we’re seeing kind of datawise compared to last year and then what we’re kind of expecting. So just in terms of some uncertainties right as we all know right, Prime Day is much later right it’s actually going to be essentially in Q4 really and leading into that holiday shopping season rather than in July. Which means to kind of the second point is that, the way shoppers are going to interact with Prime Day is going to be very different than what you’d expect out of a typical Prime Day that you’d see in July.

Andrew Waber (00:11:05):

And additionally, there might be knock-on effects when it comes to Cyber Week. If you have more people doing shopping essentially during this sales event it will that essentially impact those Cyber Week holidays. Additionally, to the second point, COVID-19, in the early days of the epidemic, we’d seen this reflecting the data, had tremendously variable effects depending on you as a seller. Some sellers saw actually incredible results from a growth perspective and you saw others have just incredibly negative effects. And so what you would see is, it really bifurcated the seller base where you saw really it was the two most common situations that you saw, from a seller perspective, were either large increases or large decreases in revenue compared to let’s say similar weeks looking back several months prior. So a lot of this was driven obviously by supply chain issues by also inventory issues when it comes to FBA and some of the restrictions that Amazon put on and we don’t know necessarily what’s going to happen, are those restrictions in some way going to be reimposed later in Q4 if things do kind of take a turn for the worse for, as an example, we hope not obviously, but there’s a potential for that.

Andrew Waber (00:12:28):

And to that degree, as I talked about, right, Cyber Week, when you think about that, it’s likely going to be very different from what you experienced in 2019, 2018. Consumers are dealing with a lot different things in their own personal lives economically and just as we talked about right with the Prime Day Sales Event moving up, et cetera, you may see these additional knock-on effects when it comes to Cyber Week. And finally, I think you know the important thing to note is that right this isn’t necessarily, there may be good news from you when you think about ecommerce because in the context of physical retail which you see more consumers maybe less likely to go out, you may see even if consumer spending decreases in aggregate, you may see a greater percentage of that spend moving to online channels, and apologize if you can hear my baby in the background. I know we’re all dealing with it. But with that, I’d love to kind of toss it over to Julie in terms of just kind of how are you thinking about you know this Q4 or maybe in the context of Prime Day or just Cyber Week in general?

Julie Atkins (00:13:32):

Yeah definitely, thank you Andrew. With Prime Day coming just in about five days with it being October 13th to the 14th. Unlike years in the past, we didn’t have the months of notice to be able to plan accordingly for inventory with it traditionally in July then with it potentially being in September and then with kind of the short notice for October, we’re really left to utilize the inventory that we have currently in Amazon FC. So right now we really focus on the 80-20 rule, so focusing on our core drivers the SKUs that are really going to be driving the majority of the revenue. We are focused on repricing and so if we start to run low in stock because we do have some peaks coming in November and December, we don’t want to run through inventory as fast as we traditionally would. So really dialing in on a SKU level to increase prices if stock is running low, decrease on some of our excess inventory. And something that I find really interesting with Amazon for this Prime Day is their push to support small businesses so they’re promoting customers with a 10% coupon if they shop between the 28th through October 12th, so that’s kind of an interesting shift.

Julie Atkins (00:15:04):

And also just to be aware of the discounts funded by Amazon, I expect that they’re really going to be pushing this during Prime Day, so if you have any sort of map policies or are cognizant of your brand being distributed to your retail partners in stores or on your website, it’s important to remove your ASINs, if that’s not a concern, then it’s a great way to get additional customers but definitely to be a cognizant of that.

Alasdair McLean-Foreman (00:15:37):

And Julie, can I step in and ask just a practical question, how would you remove those ASINs from that Amazon program, it sounds worrying it’s sort of like Amazon can actually modify the offers for your products how would you change?

Julie Atkins (00:15:53):

Yeah, so we represent a lot of brands that are more pristine so map is really important, so we create cases with Amazon and submit all of the ASINs for each brand. So contingent on know the rep that you get et cetera, it can be a very fast process, it can be a matter of days, it can also be a matter of a week or more than what we’ve seen. So it’s just a simple matter of creating a case and sharing with them all of the specific ASINs that you want protected.

Alasdair McLean-Foreman (00:16:30):

So this just seems like a classic Amazon situation where, by default, they have control over your pricing and promotion in certain cases but you have to then override that.

Julie Atkins (00:16:42):

Yeah, definitely. The way that they portray it is they identify certain products that they think should be priced lower in comparison to the market. But it gets into kind of dicey waters these days because a lot of more prestigious brands are being knocked off by kind of just private labels that don’t focus as much into the branding and advertising. So it’s kind of an uneven playing ground. So it’s important if you are a more prestigious brand to protect your imaging on Amazon in comparison to the other platforms that you’re present on.

Alasdair McLean-Foreman (00:17:27):

I know you operate both brand relationships and your own direct consumer brands at AgentRetail, does that same issue play into if you are a smaller direct consumer or do you think this concern is primarily focused on those high volume SKUs that will be sort of almost brand names?

Julie Atkins (00:17:48):

We’ve been seeing it across our catalog mostly on the high brand names. So when it first got announced a couple months ago they actually didn’t notify consumers, they simply auto enrolled sellers. So it had to be something that I actually brought up directly with a lot of the sales directors that we work with, because not only is it important for us to manage the pricing, but in certain situations, if it isn’t an entirely exclusive relationship and they have a couple other sellers that they’re working with, it’s important for everyone to be consistent as well.

Alasdair McLean-Foreman (00:18:30):

Awesome, thanks for sharing that. Yeah, I mean things are going to move so quickly and by the time you see these things I think that relates to almost that speed boat example right, you’re really moving quickly so you’ve got to be very, very much behind the wheel at this critical time. Thanks for sharing Julie, it’s awesome.

Julie Atkins (00:18:49):

Yeah, of course.

Alasdair McLean-Foreman (00:18:49):

Yeah, so Ryan is there…

Ryan Garrett (00:18:57):

Yeah, I mean just to tag on to what Julie said, with the really short notice on Prime Day, we’re approaching it the same way. We sat down as a team, we looked at what products we had in stock across our catalog that were already at FBA that we could take advantage of and that’s how we kind of crafted our Prime Day sale this year, much different than in year’s past where we were able to send in all that inventory. And then Andrew, your second point there, with the uncertainties and volatility around COVID-19, like you mentioned back in March and April Amazon blocked Nixon along with many other sellers, most other sellers from sending in any new inventory. And so in preparation or just to be on the safe side for that, rather than our typical strategy of sending smaller shipments every a couple of weeks, we did one large shipment that will hopefully get us through all of the fourth quarter, and so that’s on its way to Amazon right now.

Ryan Garrett (00:19:59):

Again, a little bit unstandard for us, we don’t like to send so much inventory and have so much tied up there at once, but not knowing and seeing what happened in March when we stocked out of, so many people were unable to replenish, that’s been big for us this Q4 in planning for what’s to come.

Andrew Waber (00:20:22):

Yeah, that’s a great point. Alasdair, I don’t know if you had anything to add on that.

Alasdair McLean-Foreman (00:20:27):

No, it’s so exciting to talk to real world examples and just curious on that point Ryan, you mentioned being completely blocked, a brand like Nixon, one of the top boutique watch brands on the Amazon platform actually struggling to get inventory in and it’s a huge holiday type product, I love your brand. So what is the current state, if you’re open to sharing, with the blocking? We’re gonna talk in a bit about the IPI score. Are you able to freely ship in and I’d love to hear from your perspective and then from Julie as well on that. What level of restriction are you currently dealing with?

Ryan Garrett (00:21:10):

Yeah, so Amazon has limited all of our ASINs. Luckily for us, the limits that they’ve placed on so far haven’t affected us, we’ve been able to send in as much as we needed without approaching those limits. But it is a little nerve-wracking seeing them there and knowing that they can be changed at any time and decreased and really affect our business and our strategy, it’s completely up to Amazon, as is everything in this type of business.

Alasdair McLean-Foreman (00:21:38):

And how do you see those limits? I think the IPI that we’ll talk about is an objective number, there’s a level of reporting that’s available of course, but for those limits that you’re describing, is there any logic or ability to predict what those might be? They could be changing at any point. I’m sort of curious, how do you, as you’re trying to navigate your ship through this very sort of exciting bumpy time, how do you find out what you’re dealing with?

Ryan Garrett (00:22:06):

Yeah so, we see the limits as we go into the shipment creation process within seller central. Luckily it seems pretty logical that Amazon kind of knows what’s happening and so our items that have better sell through have much higher limits than some of our slower moving more unique items that don’t move as fast. So it’s mostly logical, like I said, we haven’t bumped into those limits yet but they’re there and we’ve actually seen them change over time, especially as, luckily in the right way, some of our products have gained steam and started to sell faster. The limits have gradually increased, but knowing that they could decrease as well is something that we’ve [crosstalk 00:22:53].

Alasdair McLean-Foreman (00:22:53):

No, thank you. Thank you so much for sharing, it’s just so interesting. Julie, what are you dealing with?

Julie Atkins (00:22:59):

Yeah so, much like Ryan, we have limits on all of our ASINs. Amazon’s imposed them on every product. So for instance, we fortunately have a warehouse that we can store our additional product, but for instance, we are, in addition to very well known brands that we work with, kind of household names, we also help brands launch onto Amazon for the first time. So this past summer, I signed a toys company and it’s been selling very well but for instance on some of the ASINs we have limits of 200. So with Christmas coming up, we’re expecting to be selling thousands of this, so if we didn’t have the ability to store in our warehouse, we would really have to be ordering based on those ASIN limits. So fortunately, knock on wood, we have enough warehouse space to hold a lot of product. But it’s definitely something that is new, kind of Amazon always throws some bumps in the road so something that we are able to handle in-house. But yeah, it’s been something that I’ve never had to deal with before.

Andrew Waber (00:24:15):

Yeah and I think that’s… Think about all these inventories where I think is a good opportunity to move to IPI and Praveen can talk a little bit about this and kind of one of the very now important metrics when it comes to thinking about your inventory within the context of Amazon.

Praveen Kommu (00:24:33):

Sounds good. Thank you Andrew. For the folks who are for IPI, who are not familiar with IPI, IPI stands for Inventory Performance Index, and this is the metric that Amazon uses to gauge any sellers inventory performance over time. So this is, think of it like it is a dashboard or a scorecard of any seller’s performance in the way that Amazon perceives your inventory management. So this is important because a couple nuances to this is, this is only applicable for FBA SKUs that you may have if you’re a hybrid seller. And the way they scale it is, they scale it on a scale of zero to 1,000. And the inflection point that you see in the scale of 400 is key that you may want to know because this is the parameter, the score 400, this is what is going to drive the amount of space that you may have in FBA and also the amount of dollar value that you may end up paying for hosting your items in FBA warehouses.

Praveen Kommu (00:25:42):

So the fulfillment centers right now, if your score is going to be less than 400, actually, the consequence of that is not only that your space is going to be limited, you may end up paying an additional $10 per cube, for the inventory that you’re going to stack that is in addition to the other storage fee that you may pay. So that adds up very much, very quickly and it eats into your profitability. So it’s always good to manage your inventory in a way that is over 400 and beyond and that gets you this benefit. But if you can go to the next slide, the IPI is a composite score of these four characters, and this is important to know because it’s not just one thing it is an Amazon secret algorithm that they use. But these are the four components which contribute towards IPI. The sell-through rate, the excess inventory, in-stock inventory and standard inventory.

Praveen Kommu (00:26:44):

I’ll quickly go through all of these, but the most important thing here is being good on one of these four metrics does not mean that your IPI is automatically going to increase because we don’t know the proportion in which each of these things push towards IPI and also, what we want to know is these scorings are not short-term these are at a longer period of time. They want the sellers to perform well in all of these in a period of time so that the IPIa goes up, so that is another part of their composite scoring structure.

Praveen Kommu (00:27:22):

So I want to quickly walk us through the definitions of all these four factors and what Amazon is measuring. So when it comes to sell-through rate, Amazon is measuring how well you manage your inventory against your sales. Meaning, arithmetically speaking, it’s a percentage definition of the number of units you sold and shipped over the last 90 days. And to that of the average number of units you have in the FBA inventory for the same period. So in essence, what Amazon does is they take a look at your snapshot of your inventory level for today, last 30 days, 60 days, 90 days, and they average those numbers that way they have a longer term view of your inventory performance. And this helps actually in the case if you are selling cyclical or seasonal items, this actually works in your favor but that is how they are looking at sell-through rate.

Praveen Kommu (00:28:23):

But on the other hand, when it comes to an excess inventory, they are trying to measure how well you are managing your excess inventory by the definition of how much inventory do you have over 90 days or if there is inventory which has 90 days or over of weeks of supply or days of supply. So in essence, arithmetically, it is just like how much excess inventory do you have to total inventory you have. But this actually eats into not only this but also your long-term storage cost as well as it gets aging, so this is an important inventory metric that you may want to keep your eye out for.

Praveen Kommu (00:29:02):

The fourth inventory, in-stock status, this is pretty cut and dry, they’re measuring how well you keep your popular products in stock in the last 60 day period, so the time frame and popular items that they’re looking for. And the way they are calculating this is Amazon makes a correlation between the demand patterns and the in-stock patterns and that is how they’re making the correlation between these two. And it’s only concentrated also skewed towards the replenishable items only, so that is another thing that you may want to be aware of in addition to the 60-day period that you are looking. The last piece is pretty evident, so this is the standard inventory meaning you have inventory in the FBA FCs and the listing is in a way that you can’t actually, it’s not published, so they’re measuring how well a seller is able to fix the listing problems, so this is when you’re listing and the feedback that comes in are you actually in place to close the gap between that way it is actually showing up in the PDPs and all. So overall that is the ethos behind IPI and the components in it but Julie I want to turn it to you and can you share some strategies that you have been working to improve IPI in your business and how do you do that?

Julie Atkins (00:30:24):

Yeah definitely Praveen. And this year, with it being even more of a higher standard with it shifting from 400 to 500, we really have to dial into each one of these components. So we start from really the fundamentals. We start by looking at the listings. Is it fully optimized? Is it portraying all of the benefits of the product and does it tell the brand’s story? Because at the end of the day, a customer is looking at a listing and you really want them to convert to buy, so we start with the back end optimization, front end optimization, these are kind of elements that oftentimes will go overlooked. And we also really focus on pricing competitively. So if we have any sort of excess inventory, we run seasonal sales, sometimes we’ll bundle products. Also, we take advantage of the removals that Amazon provides. Something to be cognizant of with the removals is, you’re unable to ship in that product for a duration following the removal until it reaches a threshold that surpasses the trailing 90 days. So you definitely don’t want to be removing some of your top sellers.

Julie Atkins (00:31:47):

Also, something that I honestly think a lot of people might not want to naturally do, but if you have a couple SKUs, and if you only have one or two units, the disposals option is something that we utilize, Amazon does donate it, so it’s not just going to the trash, but sometimes that’s a good option. They also offer outlet sales for certain ASINs, so check in on that. And at the end of the day, we just really focus in stocking our top sellers. You never want to go out of stock on something because that’s going to hurt all the effort that you did with advertising.

Julie Atkins (00:32:27):

So yeah, each one of them is really important but something that you should also be aware of is, Amazon does have their own algorithms that impact your storage in addition to these. For instance, we have a storefront that really focuses on seasonal products, so we drive a tremendous amount of revenue just in Q4. And so, our in stock inventory was in the red but we still had a score of 650 because Amazon was anticipating the spike to come. So just be aware of your business, know the different strengths that you have and really key in on each one of these areas.

Praveen Kommu (00:33:12):

Yeah, that being said Julie, how often do you look at your IPI score and how often do you suggest the listeners here to optimize their strategy according to it?

Julie Atkins (00:33:25):

Yeah. I honestly look at it daily but that’s totally not necessary, you can check on it weekly. It changes weekly so we tend to see anywhere from two points up to nine points change in a week. And yeah it changes per quarter based on the previous quarter. Amazon tracks what your score is with the six weeks leading out into the end and then the final week of the quarter. So with those two scores, it will then impact your future availability to ship product.

Praveen Kommu (00:34:04):

Oh that’s awesome. Turning the page to inventory operations Ryan. If you don’t mind speaking a little bit about how do you use IPI to guide your inventory operations, like the day-to-day operations?

Ryan Garrett (00:34:19):

Yeah, so I mean IPI, like Julie, is something that we watch very closely, watch it even more closely the closer we get to that 500 number. And we have a weekly touch base and then a monthly operations committee at Nixon where we look at the past month’s operations and we go through each of these factors that affect our IPI to make sure that we’re managing each of them to the best that we can. So one of the things that we found actually at Nixon, like most apparel companies, we have four seasons or four product launches a year where we have new product released, and at each of those seasons we also discontinue some product. And so for a long time our in stock rate was way down in the red and it was because Amazon was recommending restocks on products that we had discontinued. And so once we had realized that and got in, and you can actually mark items as either discontinued or seasonal or non-replenishable, then they will no longer take those SKUs and have them affect you’re in stock rate.

Ryan Garrett (00:35:31):

And then on the sell through an excess inventory side, a strategy that we’re just getting into and starting to test out is Amazon’s new virtual bundles which are available to brands. And so taking some of our slower moving products and creating a virtual bundle with some of our best sellers so that Amazon will, they’ll create one ASIN and one listing page for that and you can discount it or do whatever you want to try and sweeten the offer for customers to try and move some of that slower moving inventory.

Alasdair McLean-Foreman (00:36:04):

That’s really interesting Ryan, is that a new ASIN or is it a special feature that kind of blends two ASINs together?

Ryan Garrett (00:36:11):

So it actually creates a new ASIN but it’s done through, you can do it while enrolled in FBA. So Amazon will pick both products for you and ship them together and you can create a new detail page with bundle images.

Alasdair McLean-Foreman (00:36:27):

It’s fascinating. I mean, I sort of remember 10 years ago sort of creating ASINs by bundling things together physically and you can now do that virtually so that’s awesome. Can you actually advertise those bundled ASINs as well?

Ryan Garrett (00:36:41):

Yep.

Alasdair McLean-Foreman (00:36:42):

That’s fantastic. Yeah, that makes a lot of sense so you can latch on to a winning SKU, very interesting, thank you very much for sharing. It just seems in general just listening to the two of you, there’s just consistent changes, shifting of the goal posts, and Amazon’s so big that you can literally come into a quarter, and COVID’s made it worse, and there are these new goal posts that you have to operate to. So getting that accurate information… Where do you guys look? Obviously we’re putting on this webinar to help people but how do you know when these things change? I’m curious as a seller, do you read the seller central forums? Do you find out through trial and error? I’m curious. Ryan, maybe over to you.

Ryan Garrett (00:37:29):

Yeah, so I actually follow, there’s a fulfillment by Amazon subreddit where a lot of news gets posted and a lot of good discussion takes place. So between there and the seller forums, it’s where I get a lot of my news.

Alasdair McLean-Foreman (00:37:43):

Thanks.

Praveen Kommu (00:37:45):

I just want to bring one quick thing, the scale that we had for zero to 1,000, 400 being the marker, actually that was the older news but now it is uh 500. So this is the update which was made recently so just want to bring that up before we move…

Andrew Waber (00:38:03):

Speaking of, Praveen really building on Alasdair’s point of moving the goal post, there we go again with Amazon making the minimum 500. So yeah just to move on, Alasdair, you could talk to this kind of more bringing this higher level up to profitability.

Alasdair McLean-Foreman (00:38:21):

Yeah, thank you very much. I think one of the things that we’re trying to do at Teikametrics and one of the reasons I started and built this company is just to empower our customers with the right tools to be data driven. If you look at what seller central gives you and we’ve been listening to what Amazon’s doing to change policies, it’s very, very difficult to have the right metrics. And that’s what we’ve built here and one of the most important metrics that is clearly missing from Amazon is its focus on helping you, as the seller or the brand owner, be more profitable. I think one of the most obvious points here is that Jeff Bezos’s mission, and Amazon’s mission, is lowest prices, maximum selection to consumers.

Alasdair McLean-Foreman (00:39:08):

And at Teikametrics, our customer is all of you, as the seller. And so what we’ve been doing is trying to provide better visibility of the things that matter to you, and we’ll cover that right now, is a simple math problem. And this means so much to your business, so Andrew if you skip on to the next slide please. The metric that I want to share, I’ll hand over to Praveen to talk through it, but this is one that’s very, very critical that Amazon cannot provide you because they don’t have what you care about most which is access to your cost of goods sold and really the cost of that inventory the risk. Jeff Bezos wants you to roll the dice on your dollar, not his obviously, he’s done quite well through COVID as we all know. So Praveen, over to you to talk about this metric that we’re using.

Praveen Kommu (00:40:04):

Yeah, thanks Alasdair. So this metric is a composite metric, this is very important to what Alasdair was talking about, it’s not just the IPI but the nuance which leads to the profitability of your P&L is one of the inventory drivers is this metric, so inventory turns are also sometimes called inventory turnover ratio. It is the ratio of the cost of goods sold that is your investment into your inventory, and your average inventory that you carry. So in essence, looking at the math of that one, this is your beginning inventory cost, what you have invested in, and the additional inventory that you added to in that period that you’re looking at and what was the end of the inventory that is the arithmetic of that and the average inventory is what you had in the beginning to the end of it and divided by two, this is a simple arithmetic.

Praveen Kommu (00:41:04):

But the thing is, since Amazon, in its platform, does not have COGS for most of your data, this data is missing from the platform that you are doing some of the day-to-day operations, so that is where the value of adding the inventory investment that you have, that piece is missing at this point which is critical to your profitability and a view of your inventory driving your profitability. Over to you Alasdair.

Alasdair McLean-Foreman (00:41:34):

Thank you Praveen, and here’s just a very, very simple example to illustrate what Praveen has just shared and the power of using data. So we’ve got two fictitious sellers, Seller A and Seller B. And for the purposes of comparison, we’ve said they are hypothetically doing 10 million in annual sales, which is the same. They’ve got the same COGS, which is driven by the gross margin. So in order to sell $10 million worth of stuff, it costs them $8 million dollars. From an advertising perspective, which is of course another fee that Amazon’s tacking on. When I first started selling on Amazon, I actually balked at the 15% and today with advertising and FBA fees and the commission, we’re talking more like you know 28% to 30%. So it’s really important for the audience that you use advertising spend as part of that COGS piece, because if you’re not advertising on Amazon, you’re not really going to be able to perform.

Alasdair McLean-Foreman (00:42:39):

So we’re adding that on and we’ve got that column there saying TACOS, which is 8% of your overall sales is going through ads, which is pretty high, but that’s what you need to be successful. And here is where it gets interesting. In the column highlighted or bolded, with the Seller A, she is turning her inventory, let’s say six times, and if you see that requires an average of $1.3 million at Amazon on average to output that 10 million sales target. If she’s able to compare herself to Seller B, who he is turning his inventory 10 times, there’s actually the same level of output with only $800,000 of total cash at any given time. And you can see on the far right, 60 days to turn the inventory versus 36 days, so Seller B will actually achieve the same output with 40% less cash tied up.

Alasdair McLean-Foreman (00:43:46):

And that’s a really important metric that you should be looking at and I think a lot of people overlook that because if you’re a fast growing brand and you’re getting going, you’re just driving towards that top line sales number. But I want to encourage everyone in the audience to aim for what a top, top percentile operator would do, is to continually obsess around the inventory efficiency. And I want to give Praveen an opportunity to showcase some of the ways that we’re helping and also get some feedback from Ryan and Julie, but Praveen, back over to you.

Praveen Kommu (00:44:28):

Sounds good. Hey guys, I know that all of us on this call want to be Seller B who is optimizing the inventory tool for profitability but what you see is one of these screens of how Amazon’s inventory management provides all of us to manage our inventory. So as you would see from here, the data is spread all in multiple places, let alone not having the COGS related, which is a big investment related metric included in it, all the data is put all over the place and the UX is not conducive for you, all of you run very tight ships, you have very short time frames, you need things to be on your fingertips so that you can run your business but this is all over the place. So in order to help facilitate for you to be able to get to optimizing your inventory, if you can go to the next step, this is our latest cut at how we are looking at how we can support sellers like you. So you are one of the first people outside of Teikametrics who are seeing this, this is one of the screens of the product that we are going to launch, which is inventory optimization under Flywheel 2.0.

Praveen Kommu (00:45:46):

And you will see that just in this one screen, it not only at a SKU level, it shows what is your inventory investment tied into purchase at a SKU level but it shows what is your inventory status, meaning if it is in stock, out of stock, and how much quantity you have, but most importantly if you look at the right side of this screen, the inventory turns that we just talked about at a SKU level, you would be able to see the turns at a level where you can actually manage your business. And that, tied with the estimated profit that you see the fifth column from the right, that estimated profit margin includes your advertising in it, that is a key point to Alasdair’s comment as that, as you start investing into advertising, you want to know at a SKU level, what kind of return or impact it is having on your profitability. So our cut is to take all these things, not only give you the COGS related information in one place, but also to give you all the data that you need on your fingertips to optimize your inventory.

Praveen Kommu (00:47:03):

And I don’t want you to miss that we are also going to provide forecast information 13 weeks out and longer, that way you can actually start to look ahead at your demand and start planning your inventory. So this is a part that we are going to launch pretty shortly and we will give you handouts on how to become a part of early access in this. But there are…

Alasdair McLean-Foreman (00:47:26):

And Praveen, sorry I have to just stop, could you go back Andrew. I just want to make a point. I mean, this is only someone who is really obsessed with running an ecommerce business and specifically an Amazon business would consider this beautiful right because it looks to a layman as just a sort of a spreadsheet. But I want to emphasize, to be very successful as we’ve been discussing and hearing from Julie and Ryan, you have to have the right tools, you have to be looking at the right metrics and I just want to emphasize, seller central just does not provide you that information and this is a a very simple but beautiful view because what we’re trying to do is put what’s in front of you what matters most, and it’s an obsession of profitability. I want everyone in the audience to think about the game that you’re all playing. Amazon’s shifting the goal posts, it’s a sort of three-dimensional game of poker with the the rules changing constantly, but what you should all care about is actually slightly different from Amazon, you should care about how much return on investment can you generate with a given amount of money for the smaller set of SKUs to generate the most profit absolutely at any given time. And this is where we’re starting and we’re really excited to share this and you know sorry to interrupt Praveen, I’m just super passionate about it.

Praveen Kommu (00:48:55):

Oh no, this is awesome.

Alasdair McLean-Foreman (00:48:56):

Maybe we could go on to the next slide and sort of hear from Julie and Ryan how they think about these three things, the inventory… Julie, I know that when we were talking in the rehearsal for this content, you were talking really about your obsession about these line items.

Julie Atkins (00:49:15):

Yeah definitely. I think so often people look at their business and they look at the overall profit margin, but oftentimes they overlook that that is generated from each and every product that’s carried. So I think it’s important to know your business, know your own thresholds. I will consider moving forward with certain products only if they hit our defined threshold. And it’s getting even more challenging now because with COVID, you also need to be cognizant of sometimes you’re free. So ensuring that all the different factors involved, and I feel like having this direct visibility is a game changer. I don’t know what I would be doing if I was just trying to deal with seller central because you really need to identify where you’re making your money, invest more there. Depending on the relationships that we hold with brands, sometimes the turns will vary because economies of scale are important. If you can achieve 10% off, you might be okay with a different turn ratio. But at the end of the day I think it’s important and really vital to either use tools like these or partner with experts who can really help grow your brand.

Alasdair McLean-Foreman (00:50:42):

Absolutely. How about you Ryan? I know that you talked a little bit about some of the evolution of the brands that you’ve operated and when I think you’re as big as a Nixon or other companies that you’ve been involved in, then those things come from a stakeholder perspective often.

Ryan Garrett (00:51:00):

Yeah definitely. And speaking specifically to Nixon, it’s an interesting business and I’ve dealt with a lot of brands but Nixon sells products that are between you know $100 and $600 and so managing our inventory value and really the cash that it takes to fund these sales is super important. And to your point, this is just data that’s not available in seller central. Right now, I have a pretty unwieldy spreadsheet where I pull in three or four different reports and use some macros, so having it so clear and concise like this is huge, because these are vital metrics to be tracking and monitoring if you want to be successful on Amazon or just in ecommerce and business in general.

Praveen Kommu (00:51:47):

Yeah so, I just want to quickly, there is a comment, someone wrote a comment like, I’m not a data analyst, data analysis is crucial, agree with what you are giving, but what do you suggest I do, I’m in marketing what do I suggest to do to get over this hurdle. So two comments here and I’ll leave it for the rest of the team to bring this up. One of the things a friend of mine just shared a quote with me it said it says, “Take care of the minutes and the hours will take care of themselves.” So it’s almost like if when you’re running your business, profitability sounds like a big humongous thing, but when you go into your SKUs and start optimizing your SKUs to the best turns and to profitability with them, it just compounds the effect of when your compounded profitability just comes from that. And one of the things that we do want to share this is just the first view of inventory, one of the views of inventory that we just shared, we actually, for the folks who are non-data analysts, we do have some other features in the pipeline which are actually going to aggregate these features and give you insights, meaning it will tell you what to do and where to do and you can just make a decision so those are the features which are in the pipeline as well. So Alasdair, next slide’s for you.

Alasdair McLean-Foreman (00:53:15):

Thanks.

Andrew Waber (00:53:19):

Yeah, good transition for Alasdair to talk a little bit more about that.

Alasdair McLean-Foreman (00:53:20):

Yeah. I mean, I think that just going back to the, thank you for the person being vulnerable and sharing. I mean, I totally relate to it, this idea that if you’re building a great product or starting your own direct consumer brand or operating a fantastic brand like Nixon, like Ryan is doing, that’s a whole different problem. You’ve got to deal with styles, you’ve got to deal with the industry, the competition, it’s really difficult, you’ve got to have really good IP. And I just think the challenge is you’re sort of spread thin with these different operations. But I think if you’re disciplined and you can set up a system, I think a lot of it’s about consistency. When I’ve seen people not perform so well, they get to the end of the year or tax filing season or maybe there’s some kind of meeting and they’re like, “Oh my goodness, how profitable actually was I? Or actually how much dollar value at Amazon do I really have?” And I think if you’re running the business like that, it’s going to be very, very difficult.

Alasdair McLean-Foreman (00:54:25):

So I would encourage just, the tough love for me is it’s not a fun thing to do right, to count the dollars that are at FBA, look at things like the amount of returns that you might have on a given SKU or the amount of mistakes that have been made, but those are the areas that are going to make you a good operator and I think it’s a level of teamwork. If you are really that creative person who’s the inventor of the brand, I think you have to partner with someone who’s got the mindset that you know I think Julie and Ryan, I know you’ve got an economics and accounting background and I think Nixon’s very lucky to have someone analytical in the driving seat and I think there’s a level of partnership. Of course the software can help, that’s what we’re doing here at Teikametrics. Flywheel 2.0, we’re trying to put all these things together and the arrow there with inventory optimization, we’re really excited to be able to offer this software.

Alasdair McLean-Foreman (00:55:28):

It’s in early access right now so if you visit the Teikametrics website you can sign up. And we’re going to be reaching out to you and giving you access to this technology. And it really is the only piece of software in the market that’s going to take into account the data in your advertising account using the best-in-class machine learning and AI that we have and putting that in context with your inventory. There are a lot of tools out there that are going to do some of the inventory and some of the ads or maybe you’re using a spreadsheet, as Ryan mentioned, and then you’re using ads or an agency. We want to put all these things together because they’re all interconnected. Should you be advertising if your inventory is low? Probably not.

Alasdair McLean-Foreman (00:56:10):

Or could you improve your IPI score with some advertising juice? And the answer is yes. So we want to put those tools in the same place and Praveen’s point, that’s what we’re working really hard on here. So we’d love to thank everyone for being on today. I know we’ve got a few minutes left so I’ll hand back to Andrew.

Andrew Waber (00:56:31):

Sure, thanks Alasdair and yeah we’ll send out a link again to this Flywheel 2.0 early access with the replay email so if you don’t mark it down here, you’ll get a link to it within the email and there’s some additional materials there. So yeah, we have a few minutes for questions so I wanted to get to it to a few here. I think one that was kind of a good baseline question, which I think is a good one for folks to understand around COGS is, this is a question from Harry is, to what extent are you bringing in cost of capital, supply chain logistics cost, staffing, personnel costs, kind of into this analytics at a SKU level kind of how should you think about those type of costs?

Alasdair McLean-Foreman (00:57:16):

Yeah, that’s a pretty good question. I think when you’re talking about, that’s you know the overall enterprise profitability of the business, what I would encourage, and we’re talking about lots of small moves here with respect to things like Prime Day coming and Q4, we’re talking about really sound unit economics to drive for the Amazon component of your business, a really strong gross margin. So I think when you’re talking below that line and you’re talking about overhead and cost of capital and other components of the business, those are really, really important and I’m not arguing against that. But most people get it wrong on the unit economics. It’s actually similar to now I run Teikametrics which is a software company, it’s a similar equation, how much do you CAC versus LTV, cost of acquisition versus lifetime value. It’s actually no different for an Amazon business, it’s at the end of the day, after all of those fees that you’re paying for Amazon, are you actually generating enough profit.

Alasdair McLean-Foreman (00:58:17):

So I think the lowest hanging fruit is an obsession around the gross margins and that can come in many forms, beating up your manufacturers, optimizing for price. I think a lot of people don’t optimize for pricing, being very disciplined about the advertising dollars, et cetera, et cetera. So, as I said, I think when you’re beneath the line and you’ve got your overhead and your other blended cost, those are generally pretty fixed. So really good things happen when you can nail it on the top line and maintain a level of gross margin because with Amazon, you’re in the world’s largest storefront so you can get tremendous scale flowing right to the bottom line very, very quickly. That’s how I look at it. I’m curious Ryan, you’re much better than me at accounting I’m sure, what do you think about it?

Ryan Garrett (00:59:08):

I think you nailed it. I think having a firm grasp of what your fixed costs are and then really understanding your unit economics, your variable cost per unit and pulling in everything from not just your cost of goods sold but your shipping cost, if you use a 3PL, or your warehousing costs, down to your ads and the Amazon fees, really tying all of those and knowing exactly what every unit that you sell brings you in profit and then obviously understanding your fixed cost so that you can get a clear picture of your bottom line.

Andrew Waber (00:59:43):

Great.

Alasdair McLean-Foreman (00:59:44):

Andrew. Quick questions, we got some people on, is it possible to drop the link for Flywheel in the chat just so everyone has it. I mean, I know you’re going to send out an email but [crosstalk 00:59:54].

Andrew Waber (00:59:54):

Sure, sure. Yeah, we can definitely get that in the link. I do want to… So yeah, we’ll shoot that out so everyone will see that in the chat come through just momentarily and while we’re doing that I think you know we can probably handle one final question here which I think was a good one kind of from a strategic point of view which is, this is from Amanda, looks like she’s planning on selling out of an FBA inventory in Q4 and kind of the hope is to test and relaunch again FBA in 2021 but obviously the big issue is IPI score. What should she expect kind of from a impact point of view and they’re leveraging I guess she’s just leveraging both FBA and FBM. But from an FBA perspective, with that type of strategy, how would you guys kind of feel about that within the context of your business?

Alasdair McLean-Foreman (01:00:48):

Julie, what do you think?

Julie Atkins (01:00:51):

I guess I’d be curious what the intention is of fully selling out in Q4? Is she looking to replenish? Is she looking to create new ASINs? Kind of do a variation on the product because contingent on what her product is I think it would be important to maintain inventory levels. And the Q1 storage will be impacted on her performance in Q4. So again it’s measured twice during the period so I think I’d just be curious to learn a little bit more about what the motivation is behind fully selling out. We have done such things with products that are targeted just for holiday. But for a lot of our other products, they sell well both in December as well as through January.

Andrew Waber (01:01:54):

Great. Well, I think that’s just about all the time we have and we posted the link here in the chat so for those that want to sign up for early access and additionally just to reiterate, you’re going to get a recording this presentation along with a link to early access and this full slide deck just so you can review at your own pace. So just want to thank all our presenters once again, this was a really, really great session. I definitely learned a lot here, I listen to you guys and hope you on the line did as well. So again, you’re going to record in this presentation. Thanks again for attending. We’ll see you all again soon, bye-bye.

Alasdair McLean-Foreman (01:02:29):

Thank you. Good luck everybody, take care.